Home Equity Loan Payment Calculator

Your Estimated Monthly Payment

Payment Breakdown

Quick Takeaways

- Monthly payment depends on three things: loan amount, interest rate, and loan term.

- For a $60,000 loan at a 6.5% rate over 10 years, expect about $680 per month.

- Shorter terms raise each payment but lower total interest; longer terms lower the payment but cost more overall.

- Fees, APR, and your credit score can shift the payment by a few hundred dollars.

- Use a home equity loan calculator to test different scenarios before you sign.

When you hear “home equity loan,” you probably picture pulling cash from the value you’ve built up in your house. The question most people ask right after is: “What will I actually pay each month?” This article breaks down exactly how that number is calculated, shows real‑world examples for a $60,000 loan, and gives you a checklist to avoid surprises.

Home Equity Loan is a fixed‑amount, fixed‑rate loan that uses the equity in your property as collateral. The Principal Amount refers to the money you borrow - in this case $60,000. The Interest Rate is the percentage the lender charges each year on the outstanding balance. The Loan Term defines how many months or years you have to repay the loan. From those three numbers, you get the Monthly Payment, which is the amount you’ll write a check for (or have debited) every month. Lenders also publish an APR (Annual Percentage Rate) that folds in any fees and gives a truer cost picture. An Amortization Schedule shows how each payment splits between interest and principal over time. Finally, the Lender is the bank, credit union, or online lender that offers the loan.

What Is a Home Equity Loan?

A home equity loan lets you borrow a lump sum against the equity you own in your house. Equity is simply the market value of your home minus what you still owe on your mortgage. If your house is worth $400,000 and you owe $250,000, you have $150,000 in equity. Most lenders let you tap 70‑80% of that equity, so a $60,000 loan is often well within the limit.

Because the loan is secured by your property, interest rates are typically lower than unsecured personal loans or credit cards. The loan is “fixed‑rate,” meaning the interest rate stays the same for the whole term, and you receive the full amount up front rather than a revolving line of credit (that would be a HELOC).

How Monthly Payments Are Calculated

The math behind a monthly payment is the same as any amortizing loan. The standard formula is:

Monthly Payment = P × r × (1 + r)^n / [(1 + r)^n - 1]

Where:

- P = Principal amount (the $60,000 you borrow)

- r = Monthly interest rate (annual rate ÷ 12)

- n = Total number of payments (years × 12)

If you plug in the numbers, you’ll see how the three variables shape the payment.

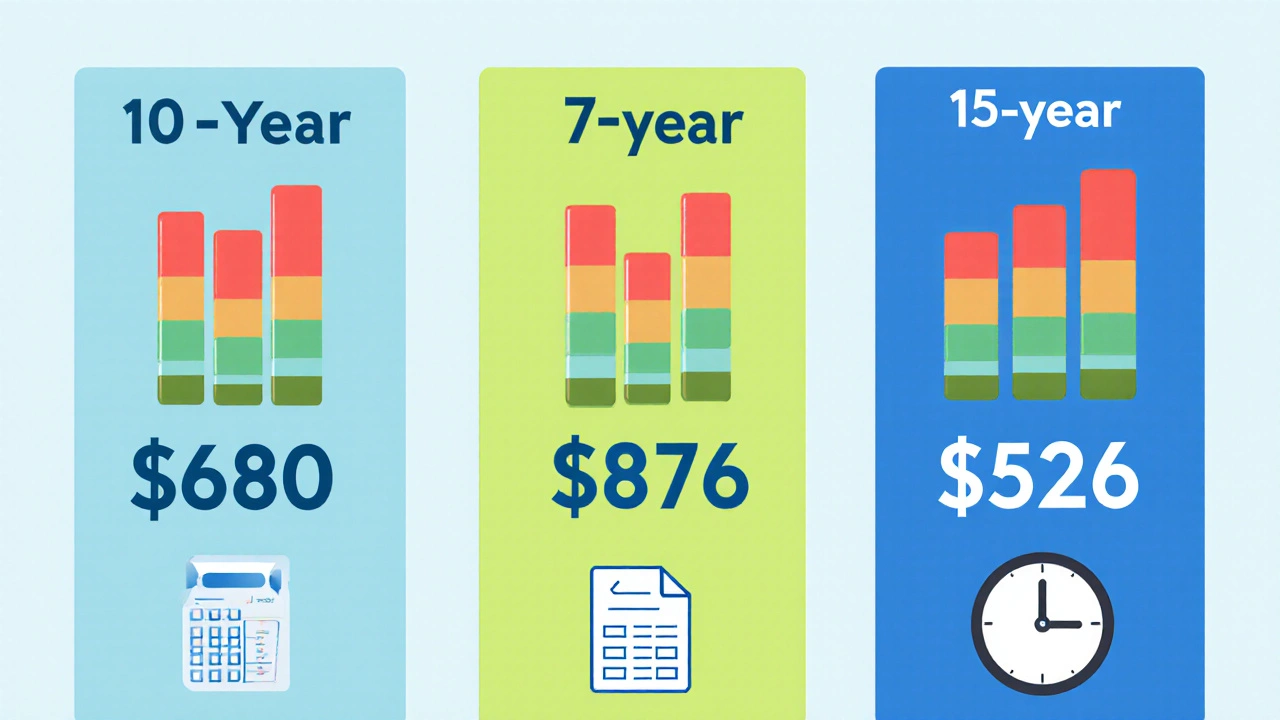

Example: ,000 Loan at Different Rates and Terms

Below are three common scenarios. All assume a 6.5% annual interest rate - a realistic figure for a borrower with good credit in 2025.

- 10‑year term (120 months)

- Monthly rate = 6.5% ÷ 12 = 0.5417% (0.005417 as a decimal)

- Payment ≈ $680.15 per month

- 7‑year term (84 months)

- Monthly rate = 0.005417

- Payment ≈ $876.24 per month

- 15‑year term (180 months)

- Monthly rate = 0.005417

- Payment ≈ $525.84 per month

Shorter terms mean higher monthly bills but you pay far less interest overall. A quick calculation shows the 7‑year loan costs about $31,000 in total payments, while the 15‑year version tops out near $95,000 - a difference of roughly $64,000 in interest.

Factors That Can Change Your Payment

- Interest rate changes: Even a half‑point swing (e.g., 6% vs 6.5%) shifts a 10‑year payment by about $30 per month.

- Loan fees: Origination fees, appraisal costs, and document fees are often rolled into the APR. A 1% fee on $60,000 adds $600 to the effective loan balance.

- Credit score: Better scores typically qualify for lower rates. A drop from 750 to 650 could add 1%‑1.5% to the rate.

- Property value: If your home’s market value falls, lenders may lower the maximum loan‑to‑value (LTV) ratio, forcing you to borrow less or bring cash to the table.

How to Choose the Right Home Equity Loan

Not every lender offers the same deal. Use this quick comparison to spot the sweet spot.

| Lender | Interest Rate (APR) | Origination Fee | Maximum LTV | Best For |

|---|---|---|---|---|

| BigBank | 5.9% (6.2% APR) | 0.5% of loan | 80% | Low‑fee borrowers |

| Co-op Credit Union | 6.1% (6.4% APR) | 1.0% of loan | 85% | Members seeking higher LTV |

| OnlineLend | 6.5% (6.9% APR) | 0% upfront (higher rate) | 75% | Fast approval, no fee upfront |

Look at the whole picture: a lower rate with a high fee might cost you more than a slightly higher rate with no fee. Run the numbers in a calculator and compare the total payment over the life of the loan.

Using a Home Equity Loan Calculator

Most banks provide a free online calculator. If you prefer to do it yourself, here’s a simple spreadsheet setup:

- Enter the principal ($60,000).

- Enter the annual interest rate (e.g., 6.5%).

- Enter the loan term in years (e.g., 10).

- Use the formula =PMT(rate/12, term*12, -principal) to get the monthly payment.

Test multiple “what‑if” scenarios - change the rate, add a fee, or shorten the term - to see how each tweak impacts your budget.

Checklist Before Signing the Loan

- Confirm the exact interest rate (fixed vs variable).

- Ask for the APR, which includes all fees.

- Verify the total number of payments and the final payoff date.

- Check for pre‑payment penalties - some lenders charge a fee if you pay off early.

- Make sure you understand how the loan will be disbursed (lump sum vs staggered payments).

- Review your budget to ensure the monthly payment fits comfortably.

Common Mistakes to Avoid

- Assuming the advertised rate is the whole story - always ask for the APR.

- Choosing the longest term just to lower the monthly bill - you may end up paying double the interest.

- Ignoring fees that are rolled into the loan balance - they increase both the payment and total cost.

- Using the home equity loan as a cash‑out for non‑essential purchases - it puts your house at risk.

Bottom Line

For a $60,000 home equity loan, the monthly payment is a function of the rate you lock in and the length of the term you pick. At a 6.5% fixed rate, a 10‑year term yields roughly $680 per month, while a 7‑year term pushes it close to $880 and a 15‑year term drops it under $530. Run your own numbers, compare lenders side‑by‑side, and keep an eye on fees and APR to avoid hidden costs.

Frequently Asked Questions

Can I get a home equity loan if I already have a mortgage?

Yes. Lenders usually allow a second loan as long as the combined loan‑to‑value (LTV) stays under their limit, often 80‑85% of the home’s appraised value.

What’s the difference between a home equity loan and a HELOC?

A home equity loan gives you a fixed lump sum with a set interest rate and monthly payment. A HELOC works like a credit card - you have a credit line, draw as needed, and the rate may vary.

Do I pay taxes on the money I receive from a home equity loan?

Generally, no. The loan is not considered income, so you don’t report it on your tax return. However, you can’t deduct the interest unless the money is used for home improvements.

How does my credit score affect the rate I get?

Higher scores (720+) typically qualify for rates 0.5%‑1% lower than borrowers with scores around 650. Lenders use the score to gauge risk and set the interest rate accordingly.

Can I pay off the loan early without a penalty?

It depends on the lender. Some lenders waive pre‑payment penalties, while others charge a fee equal to a few months’ interest. Always ask before you sign.