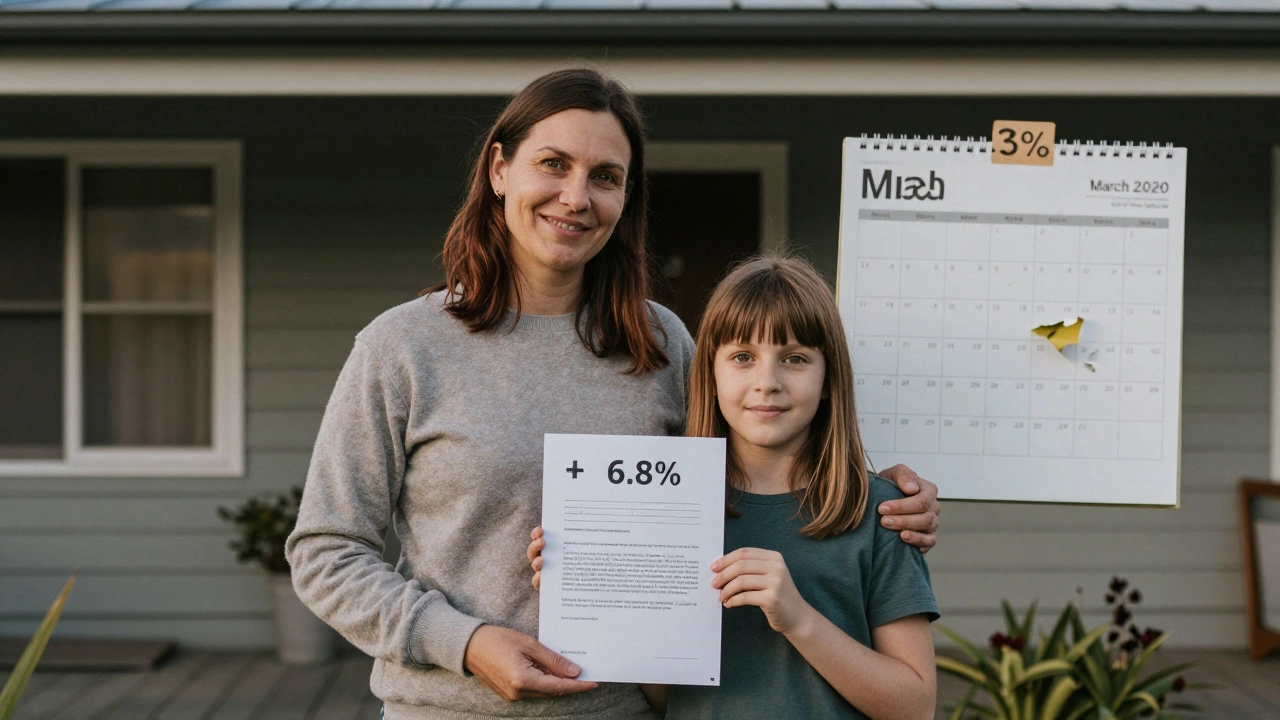

Will mortgage rates ever be 3% again?

Mortgage rates in New Zealand are near 7% in 2026. Will they ever return to 3%? History, economics, and market trends suggest it's highly unlikely - and waiting for it could cost you more than you save.

Looking for a card that fits your lifestyle? We break down the basics so you can pick a credit card without getting lost in jargon. From travel rewards to low interest rates, we cover the most common features that matter to everyday users.

Our side‑by‑side tables let you see annual fees, interest rates, and bonus points at a glance. Want a card with no foreign transaction fees? Just tick the box. Need a balance transfer deal? You’ll spot the best offer in seconds.

Having the right card is only half the game. Pay your balance in full each month, keep utilization under 30%, and set up automatic reminders. Those simple habits can lift your score fast, opening doors to better rates and higher limits.

Ready to start? Browse our top picks, read the short reviews, and use the comparison tools to find the card that matches your goals. It’s that easy.

Mortgage rates in New Zealand are near 7% in 2026. Will they ever return to 3%? History, economics, and market trends suggest it's highly unlikely - and waiting for it could cost you more than you save.

No UK bank offers 7% interest on savings accounts, but top rates are hitting 6.25% through fixed-term ISAs. Learn where to find the safest, highest-paying accounts in 2026 - and how to avoid scams.

In 2026, $1000 in a standard savings account earns just $18, but switching to a high-yield account can earn you over $50. Learn how interest rates, compounding, and account types affect your returns-and what to do right now.

In 2026, three New Zealand banks are offering savings accounts with interest rates near 7%. Learn who they are, what the requirements are, and how to qualify without risking your money.

Closing a credit card with a zero balance might seem smart, but it can hurt your credit score. Learn why keeping it open - even unused - often helps more than closing it.

Can $500,000 plus Social Security fund your retirement? It depends on where you live, how you spend, and how long you live. This guide breaks down real costs in Auckland and shows how to stretch your savings safely.

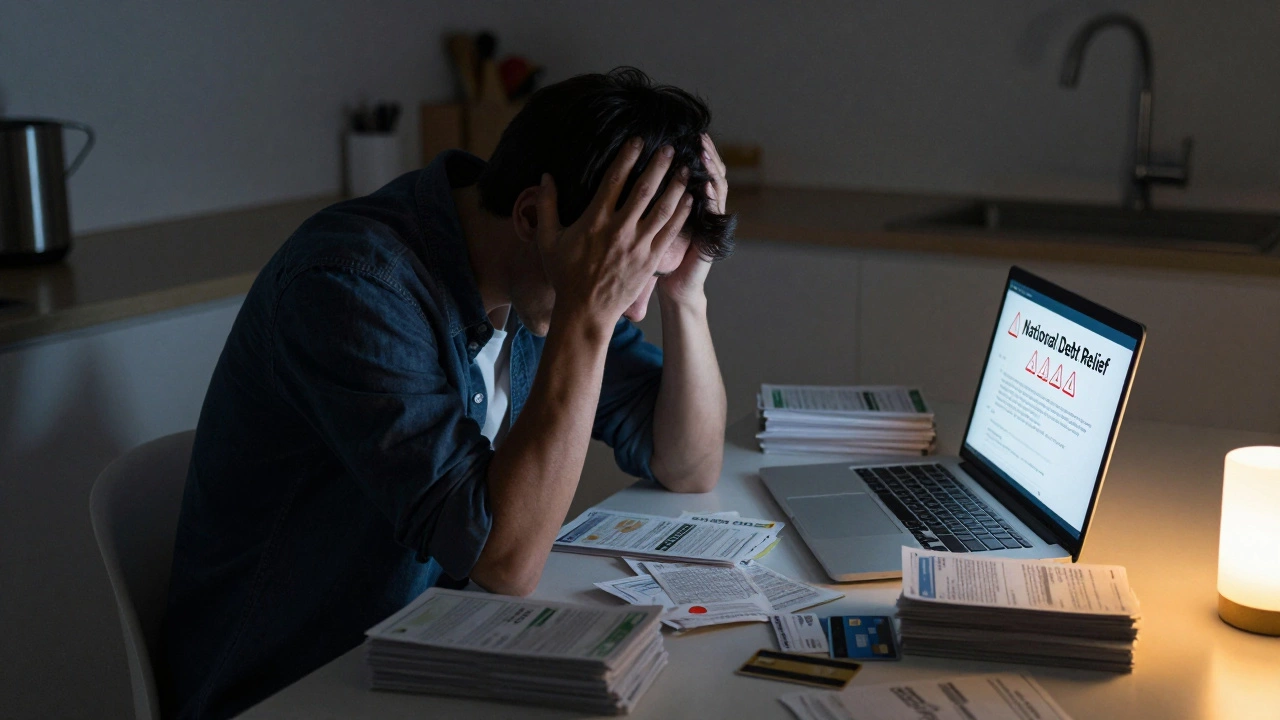

National debt relief isn't a government program-it's a marketing trick used by companies that often make your debt worse. Learn what actually works to reduce debt without scams, fees, or credit damage.

The 40-40-20 budget rule helps you tackle debt by allocating 40% of income to necessities, 40% to debt repayment and savings, and 20% to lifestyle. It’s a practical path out of financial stress without extreme cuts.

Equity release offers quick cash but comes with hidden risks: compounding interest, lost inheritance, high fees, and reduced access to government support. Know the real downsides before signing.

In New Zealand, building-only home insurance is typically the cheapest option, often costing under $500 a year. Contents insurance and extra features drive up costs - knowing what you really need saves hundreds.

At 75, staying in the stock market isn’t about chasing growth-it’s about protecting your purchasing power. With inflation and longer lifespans, a balanced portfolio with dividend stocks and ETFs can help your money last longer than cash or bonds alone.

Having four credit cards isn't automatically bad-but it's not automatically good either. What matters is how you use them: pay on time, keep balances low, and avoid unnecessary debt. Learn when four cards help your credit-and when they hurt.