40-40-20 Budget Calculator

Calculate Your Budget Allocation

See how your income should be divided using the 40-40-20 budget rule. This helps prioritize debt repayment while maintaining quality of life.

Pro Tip: Start with a $50 monthly increase in debt payments. This small change can save hundreds in interest and shorten your repayment timeline.

Source: University of Auckland studies on debt reduction strategies

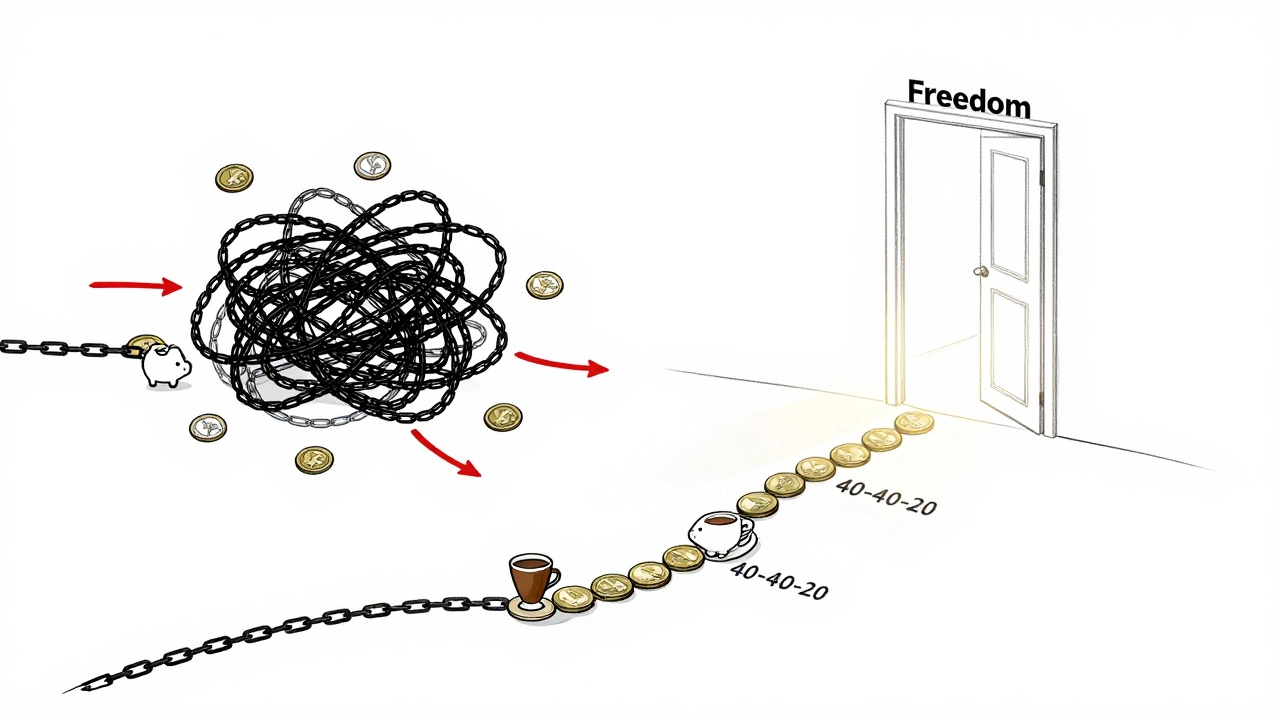

Most people think budgeting is about cutting back-giving up coffee, skipping takeout, or wearing the same clothes for months. But what if the real problem isn’t what you’re spending, but how it’s distributed? The 40-40-20 budget rule flips the script. It doesn’t ask you to starve. It asks you to align your money with what actually moves you toward freedom.

What the 40-40-20 Rule Actually Means

The 40-40-20 rule is a simple way to divide your after-tax income into three buckets:

- 40% for necessities - rent, groceries, utilities, basic transportation, minimum debt payments

- 40% for debt repayment and savings - paying down credit cards, student loans, building an emergency fund, contributing to retirement

- 20% for lifestyle spending - dining out, hobbies, travel, subscriptions, impulse buys

This isn’t a one-size-fits-all rule. It’s a framework for people drowning in debt but still trying to live. If you’re paying 60% of your income just to keep up with minimum payments and rent, you’re stuck. The 40-40-20 rule says: you can break that cycle without becoming a hermit.

Why This Works Better Than 50/30/20

You’ve probably heard of the 50/30/20 rule: 50% needs, 30% wants, 20% savings. Sounds nice. But here’s the problem: if you owe $15,000 in credit card debt at 22% interest, 20% savings won’t save you. That debt is eating your future. The 40-40-20 rule treats debt like the emergency it is.

In New Zealand, the average household carries $4,800 in credit card debt. At 20% interest, that’s nearly $1,000 a year in interest alone. If you’re only paying minimums, you could be stuck for 15 years. The 40-40-20 rule says: stop treating debt like a background noise. Make it a priority equal to your rent.

Let’s say you earn $5,000 a month after tax:

- $2,000 on rent, groceries, bills, minimum payments

- $2,000 on crushing debt and building savings

- $1,000 on everything else

That $2,000 for debt and savings? That’s where the magic happens. You’re not just paying the minimum anymore. You’re attacking the balance. You’re also building a buffer so you don’t go back into debt when your car breaks down or the fridge dies.

How to Start Using the 40-40-20 Rule

Here’s how to make it work in real life:

- Track your spending for 30 days. Use your bank app or a free tool like PocketGuard. Don’t judge. Just see where your money goes.

- Classify every expense. Is it a necessity? A debt payment? Or a want? Be honest. That $80 monthly Spotify subscription? That’s a want. That $120 gym membership you never use? That’s a waste.

- Calculate your after-tax income. This is your baseline. Don’t use gross. Use what actually lands in your account.

- Adjust your spending. If necessities are 55%, you need to cut back. Maybe you move to a cheaper flat, switch to a cheaper phone plan, or cook one more meal at home. If debt payments are only 15%, you need to redirect some of that 20% lifestyle money.

- Automate the 40% debt/savings bucket. Set up two automatic transfers on payday: one to your debt account, one to a savings account. Out of sight, out of mind.

Real Example: Maria’s Story

Maria, 34, works as a dental assistant in Auckland. She earns $4,200 after tax. She was paying $450/month in minimum payments on $18,000 in credit card debt. Her rent was $1,600. Groceries, phone, and transport? $1,000. That left $1,150 for everything else-hobbies, takeout, clothes, Netflix.

She was stuck. Every time she paid down a card, she’d use it again. Her credit score was 580.

She switched to the 40-40-20 rule:

- 40% necessities - $1,680 (rent $1,600, groceries $80)

- 40% debt + savings - $1,680 (she put $1,400 toward debt, $280 into emergency fund)

- 20% lifestyle - $840 (she cut Netflix, canceled two subscriptions, and limited takeout to once a week)

Within 10 months, she paid off $12,000 of debt. Her credit score jumped to 720. She didn’t quit life. She just stopped funding her anxiety.

What If Your Necessities Are Over 40%?

This is the hard truth: if your rent and bills are already 50% or more, the 40-40-20 rule isn’t broken. You just need to change your environment.

You can’t magically make rent cheaper. But you can:

- Get a flatmate

- Move to a less expensive suburb

- Switch to a cheaper internet or mobile plan

- Apply for government assistance if eligible

Every dollar you shave off necessities gives you more room to attack debt. In New Zealand, a 10% drop in rent can free up $150-$300 a month. That’s 12-24 months of debt payoff.

Why You Need the 20% Lifestyle Bucket

Most debt plans fail because they’re too rigid. You cut out everything. Then you crash. You binge. You max out the card again.

The 20% lifestyle bucket isn’t a luxury. It’s your safety valve. It’s the reason you stick to the plan. You get to go out with friends. You get to buy that book. You get to enjoy your life while getting out of debt.

Studies from the University of Auckland show that people who allow themselves small, planned rewards are 3x more likely to stick with a debt plan for over a year. The 40-40-20 rule isn’t about deprivation. It’s about control.

What Happens After You Pay Off Debt?

Once your debt is gone, the 40-40-20 rule doesn’t disappear. It evolves.

Your 40% debt bucket becomes 40% savings and investing. You’re now building wealth instead of fighting fire. You might:

- Boost your emergency fund to 6 months of expenses

- Start contributing to KiwiSaver

- Invest in low-cost index funds

- Save for a home deposit

That’s the real win. The 40-40-20 rule isn’t a temporary fix. It’s a lifelong system for financial peace.

Common Mistakes to Avoid

- Thinking it’s a debt-only plan - You still need to save. A $500 emergency fund stops you from going back into debt.

- Ignoring minimum payments - If you’re behind on payments, you’ll get hit with fees and penalties. Stay current even as you ramp up.

- Using credit cards during this phase - Freeze them. Cut them up. Or put them in a jar of water in the freezer until you’re debt-free.

- Comparing yourself to others - Your neighbor might have a $300 car payment. Yours is $800. That’s fine. Your plan is yours.

Final Thought: It’s Not About Money. It’s About Control.

The 40-40-20 rule doesn’t make you rich overnight. But it gives you something rarer: agency. You stop being a victim of your spending. You stop blaming your income. You start making choices.

Debt isn’t just a number. It’s stress. It’s sleepless nights. It’s avoiding calls from unknown numbers. The 40-40-20 rule doesn’t promise a perfect life. But it gives you a clear path out of the mess-and the freedom to build something better on the other side.

Is the 40-40-20 budget rule suitable for someone with very low income?

Yes, but you may need to adjust the percentages. If your income is below $3,000/month after tax, you might start with 50-30-20: 50% necessities, 30% debt repayment, 20% lifestyle. The goal isn’t to hit exact numbers-it’s to prioritize debt reduction over lifestyle spending. Even small increases in debt payments-like $50 extra per month-can cut years off your repayment timeline.

Can I use the 40-40-20 rule if I have student loans?

Absolutely. Student loans count as debt in the 40% bucket. Even if they have low interest, paying more than the minimum reduces the total you’ll pay over time. In New Zealand, student loans are interest-free while you live here, so focus on credit card and high-interest debt first. Once those are gone, redirect that 40% toward paying off your student loan faster.

Do I need to use a budgeting app to follow this rule?

No, but it helps. You can use pen and paper, a spreadsheet, or just your bank’s transaction history. The key is consistency. If you check your spending weekly, you’ll catch leaks early. Apps like PocketGuard or Spendee can auto-categorize your expenses, making it easier to stay within your 40-40-20 splits.

What if I get a raise or bonus? Should I increase my debt payments?

Yes-and do it immediately. A raise or bonus should go straight into the 40% debt and savings bucket. Don’t upgrade your lifestyle. Don’t buy new gadgets. Use that extra money to shorten your debt timeline. Paying off $5,000 extra this year could save you $1,000 in interest and free up $200/month for future goals.

Can I still go on vacation while following this rule?

Yes, but plan for it. Put aside $50-$100 a month in your 20% lifestyle bucket for travel. When you have enough saved, go. No credit cards. No loans. Just cash you’ve saved. This way, you enjoy the trip without adding debt. Many people who follow this rule end up taking more meaningful trips because they’re not rushing to pay them off later.