Equity Release Interest Calculator

Calculate Your Equity Release Debt

Enter the details to see how your debt can grow with compounding interest over time.

What This Shows

This calculator demonstrates how quickly equity release debt grows with compounding interest. Unlike a regular mortgage, equity release typically compounds interest annually with no monthly payments, leading to exponential growth over time.

Estimated Debt After 0 Years

$0

This shows the total debt including compounded interest

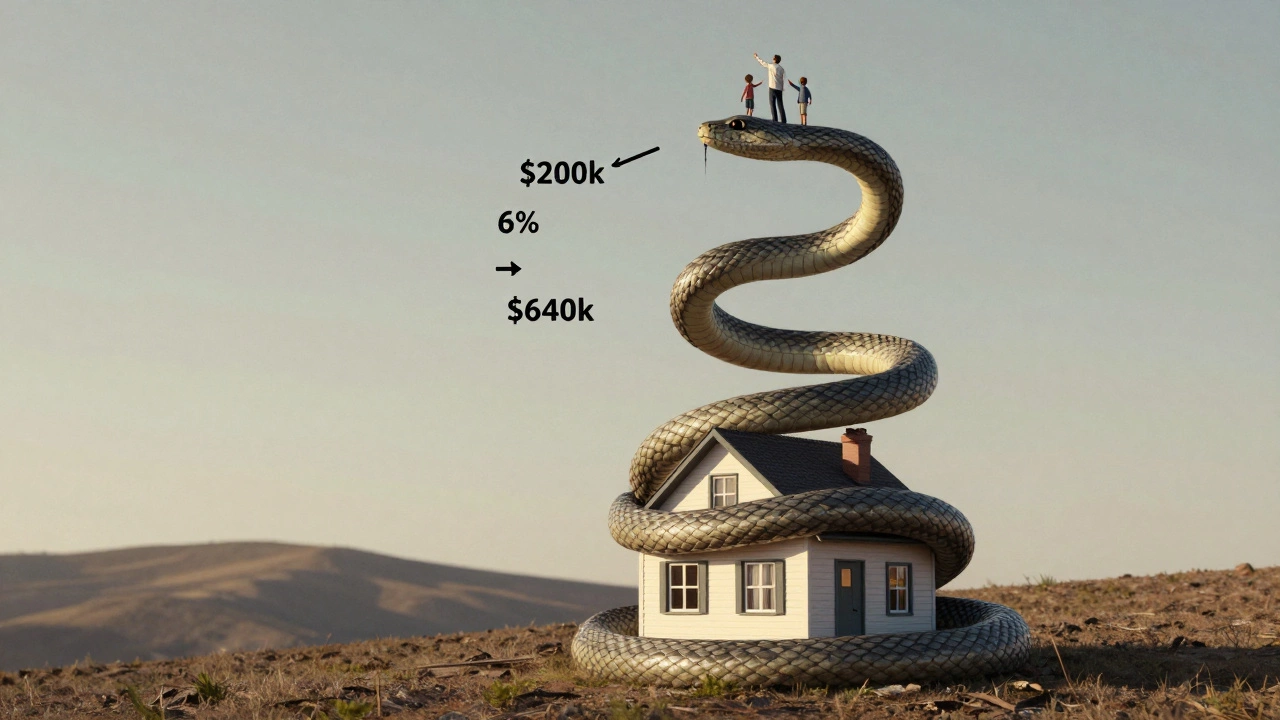

Example: A $200,000 loan at 6% interest compounds to $360,000 after 10 years and $640,000 after 20 years.

Equity release sounds simple: unlock cash from your home without moving. For many older homeowners in New Zealand, it’s a lifeline - paying for medical care, helping family, or just making life more comfortable. But behind the promise of quick cash lies a web of hidden costs, long-term consequences, and traps that can leave families scrambling years later. This isn’t about scare tactics. It’s about real, documented downsides that most advisers downplay.

You lose control of your home

When you take out an equity release plan, you’re not just borrowing money. You’re giving up part of your ownership. Most plans work by letting you borrow against your home’s value while staying in it. But if you die or move into long-term care, the loan becomes due. That means your home may have to be sold - even if your children were counting on inheriting it. No will, no promise, no emotional attachment changes that. Banks and lenders don’t care about sentiment. They care about repayment.

One Auckland widow, 78, took out a lifetime mortgage in 2020 to cover her husband’s care costs. By 2025, the interest had ballooned to 68% of the home’s value. Her daughter, who had lived there since childhood, had to move out because the bank required full repayment. The house sold for $850,000. After fees, interest, and legal costs, the daughter received $112,000. That’s not inheritance. That’s a financial afterthought.

Interest compounds - fast

Unlike a regular mortgage, equity release interest usually compounds. That means you’re paying interest on interest. No monthly payments? Sounds great. Until you realize that every year, your debt grows. A $200,000 loan at 6% annual interest doesn’t just become $212,000 after a year. It becomes $224,720. After ten years? Over $360,000. After 20? More than $640,000.

Most people assume they’ll repay it eventually - maybe with savings, or by downsizing. But life doesn’t always work that way. Health declines. Income stops. Family support fades. What starts as a small loan can become a debt bigger than your home is worth. In 2024, New Zealand’s Financial Markets Authority found that 42% of equity release customers ended up owing more than their property’s market value.

It cuts into your estate - and your family’s future

Equity release doesn’t just affect you. It affects everyone who might inherit your home. Even if you have a will that says your house goes to your grandchildren, the lender gets first claim. Any leftover value? That’s it. No more. No exceptions.

One family in Hamilton had planned to use the family home as a holiday base for their kids and grandkids. After the parents took out a £150,000 equity release plan (equivalent to about NZ$310,000), the debt grew faster than expected. By the time the last parent passed, the home was worth $480,000 - but the debt was $410,000. The kids got $70,000. They had to pay legal fees to settle the estate. They lost the house. And the memories.

You can’t easily change your mind

Most equity release agreements have early repayment penalties - sometimes as high as 25% of the amount borrowed. If your situation changes - say, your child gets a job overseas and can help with care - you can’t just pay it off without a financial hit. You’re locked in. And unlike a home loan, there’s no refinancing option that’s simple or cheap.

One woman in Tauranga took out a plan in 2021 to pay off credit card debt. Within a year, her daughter offered to help her move into a smaller, rent-free unit. She wanted to repay the loan and save on interest. The penalty? $37,000. She stayed in the house, trapped by her own decision.

It limits your options later

Once you’ve released equity, your ability to access other financial help shrinks. Need a home modification for mobility? Need extra care? Most government subsidies - like the Accommodation Supplement or Home Repair Grants - require you to have limited assets. If your home equity is tied up in a loan, you may be disqualified. Even if you’re eligible, your application gets flagged because you’ve already accessed capital. You’ve burned your bridge.

That’s not theoretical. In 2023, 19% of applicants for NZ’s Community Services Card were denied because they had outstanding equity release debt. They weren’t wealthy. They were simply caught in a system that didn’t account for how these loans lock you out of future support.

Fees are higher than you think

Advisers often say, “It’s just a small setup fee.” But the real cost is hidden. Legal fees, valuation fees, broker commissions, arrangement fees, ongoing administration charges - they add up. In New Zealand, the average total cost of setting up an equity release plan is between $12,000 and $18,000. That’s not a one-time cost. That’s money taken from your home’s value before you even get a dollar.

Compare that to a standard home equity loan. You can get one with a bank for under $2,000 in fees - and you can pay it off anytime. Equity release? Not so much.

You might not qualify for what you need

Not everyone can get equity release. Lenders set strict rules: minimum age (usually 60+), property value (often over $400,000), and property condition (no major repairs needed). If your home is older, in a rural area, or needs a new roof, you might be turned down. And if you’re declined, you can’t just go to another lender - most use the same criteria. You’re stuck.

One man in Napier, 72, wanted to release $100,000 to help his granddaughter with university. His home was worth $520,000. He was rejected because his property had a timber frame and no recent building certification. He had no savings. He couldn’t afford repairs. He ended up selling his car to cover the cost.

It can affect your benefits

If you receive a government pension or allowance - like New Zealand Superannuation or Accommodation Supplement - the money you get from equity release could be counted as income or an asset. That means your payments could be reduced or cut entirely. Even if you don’t spend the cash, just having it in your account can trigger a review.

There’s no universal rule. Each agency interprets things differently. One person in Christchurch had their Superannuation reduced by $80 a week because they had $50,000 in their bank account from an equity release payout. They didn’t even touch it. Just having it was enough.

There are better alternatives

Before you sign anything, ask: Is this really the only way?

- Selling and downsizing: Move to a smaller home. Keep the difference. No debt. No interest. No risk.

- Family support: Talk to your children. Many are willing to help if they understand the full picture - not just the cash.

- Part-time work or rentals: Rent out a room. Work part-time. Even $300 a week adds up over time.

- Home equity loan: If you’re under 70 and healthy, banks still offer these with fixed rates and no compounding interest.

One Wellington couple, both 75, chose to rent out their garage and move into half their house. They cut their bills, saved $2,000 a month, and kept full ownership. No loans. No debt. No stress.

Final thought: It’s not wrong - but it’s risky

Equity release isn’t evil. For some, it’s necessary. But it’s not a simple solution. It’s a trade-off: cash now, control later. Freedom today, limits tomorrow. The biggest downside isn’t the interest rate. It’s the silence around what happens after you sign. No one tells you about the penalties. The lost inheritance. The missed benefits. The locked-in debt.

If you’re considering it, get independent advice - not from the company offering the plan. Go to a fee-for-service financial planner who doesn’t earn commission. Ask for a written breakdown of every fee. Ask what happens if you live 25 more years. Ask how much your children will get. And then, sleep on it. For a week. Then ask again.

Can you lose your home with equity release?

You don’t lose your home while you’re alive and living in it. But when you die or move into long-term care, the loan must be repaid - usually by selling the property. If the debt exceeds the home’s value, your estate may owe the difference, depending on the plan type. Most modern plans in New Zealand have a "no negative equity guarantee," meaning you or your heirs won’t owe more than the home sells for.

How much does equity release cost in New Zealand?

Total setup costs typically range from $12,000 to $18,000, including legal fees, valuation, broker commissions, and lender charges. Interest compounds annually, often at 5%-7%, meaning your debt can double in 10-15 years. Ongoing administration fees of $200-$500 per year are also common.

Can you still get government benefits after equity release?

It depends. If you receive the money as a lump sum and keep it in the bank, it may be counted as an asset and reduce or cancel means-tested benefits like the Accommodation Supplement. If you take it as regular payments, it may be treated as income. Always check with Work and Income before signing any agreement.

Is equity release better than selling your home?

Selling and downsizing usually costs less, gives you full control, and avoids compounding interest. You keep all the profit without debt. Equity release lets you stay in your home, but at the cost of long-term financial flexibility and potential inheritance loss. For many, selling is the safer, simpler option.

What happens if you outlive your equity?

You don’t “outlive” your equity - the debt keeps growing. But most reputable plans in New Zealand include a "no negative equity guarantee," meaning you or your estate will never owe more than the home sells for. However, your heirs still lose everything if the debt eats up the entire value. That’s the real risk.