Car Loan Rate Calculator

Calculate Your Car Loan

See how much you could save by choosing the right lender. Based on current rates from November 2025.

Your Results

Best Lender for You

If you're shopping for a car in New Zealand right now, the biggest question isn't just which model to pick-it's which bank gives you the lowest car loan interest rate. With inflation easing and the OCR dropping in late 2024, rates have finally started to come down after years of sky-high numbers. But not all banks are offering the same deal. Some are still clinging to older, higher rates. Others are fighting for customers with aggressive offers. Here’s what’s actually happening in late 2025, and who’s giving you the best deal.

Right now, the lowest rates are coming from non-traditional lenders

You might expect the big four banks-ANZ, ASB, BNZ, and Westpac-to lead the pack. But in 2025, they’re not. Their standard new car loan rates hover between 7.2% and 8.5% for borrowers with excellent credit. That’s still high compared to what’s out there.

The real savings are coming from credit unions and specialist finance companies. As of November 2025, Co-operative Bank is offering 5.99% fixed for 5 years on new cars under $40,000, if you’re a member and have a clean credit history. That’s nearly 2 percentage points lower than the big banks. Same goes for TSB-they’re running a limited-time promotion at 6.19% for first-time car buyers under 30.

Even more surprising? Heartland Bank and KiwiBank are matching those rates for customers who set up direct debit and have a savings account with them. You’re not just getting a loan-you’re being rewarded for being a loyal customer.

What actually affects your rate?

It’s not just which bank you pick. It’s who you are. Lenders don’t just look at your credit score-they look at your whole financial picture.

- Down payment: Putting down 20% or more can drop your rate by 0.5% to 1.5%. If you’re buying a $30,000 car and put $6,000 down, you’re not just reducing your loan-you’re signaling you’re low risk.

- Loan term: A 3-year loan will almost always have a lower rate than a 7-year one. But your monthly payment will be higher. Most people pick 5 years-it’s the sweet spot between affordability and rate.

- Car age: New cars get better rates. Used cars over 5 years old? Rates jump. Some lenders won’t even lend on cars older than 8 years. If you’re looking at a 2018 model, expect to pay at least 7.5%.

- Employment status: If you’ve been in the same job for 2+ years, you’ll get a better rate than someone on a 6-month contract. Even if your income is the same.

One real example: A customer in Hamilton got 6.3% on a new Toyota Corolla because she had a 25% down payment, a 5-year term, and had been with KiwiBank for 7 years. Her friend in Tauranga, same car, same credit score, but only 5% down and no existing account-got 8.1%.

Compare these 5 lenders side by side

Here’s what’s actually available as of November 2025. These are real rates from lenders actively advertising in New Zealand right now. Rates are for borrowers with credit scores above 750, 20% down payment, 5-year term, new car only.

| Lender | Rate (fixed) | Term | Min. Down Payment | Special Conditions |

|---|---|---|---|---|

| Co-operative Bank | 5.99% | 5 years | 15% | Must be a member; new cars only |

| KiwiBank | 6.19% | 5 years | 10% | Must have savings account + direct debit |

| TSB | 6.19% | 5 years | 15% | Only for first-time buyers under 30 |

| Heartland Bank | 6.29% | 5 years | 10% | Requires salary deposit into Heartland account |

| ANZ | 7.25% | 5 years | 20% | No special conditions, but no discounts |

Notice something? The top three are all smaller lenders. The big banks are still charging more. Why? They don’t need to compete as hard. Their customers stay out of habit. But if you’re willing to switch, you can save thousands over the life of the loan.

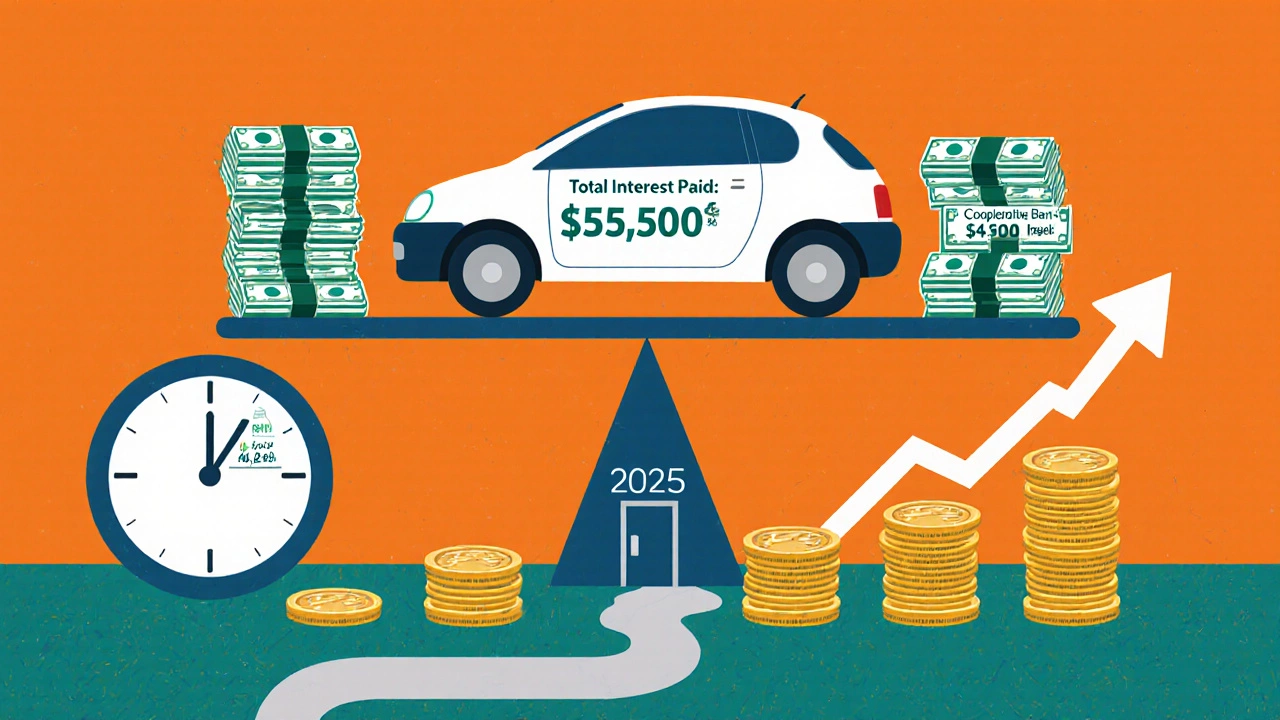

How much can you actually save?

Let’s say you’re buying a $35,000 car. You put down $7,000, so you’re borrowing $28,000 over 5 years.

- At 8.5% (big bank average): Your monthly payment is $575. Total interest paid: $6,500.

- At 6.19% (KiwiBank or TSB): Your monthly payment is $541. Total interest paid: $4,660.

That’s a $1,840 difference in interest alone. Plus, you’re paying $34 less every month. That’s enough to cover a full tank of petrol or a monthly gym membership. Over five years, that’s $2,040 in extra cash in your pocket.

And if you go with Co-operative Bank at 5.99%? You’re down to $539 a month and $4,540 total interest. That’s $2,000+ saved compared to the big banks.

Don’t fall for these traps

Some lenders make it look like you’re getting a great deal-but there’s a catch.

- “0% finance” deals: These are usually from dealerships, not banks. They’re often only for the first 6 months. After that, the rate jumps to 12% or more. And if you miss a payment, you lose the deal and get charged back interest. Avoid unless you’re 100% sure you can pay it off in half a year.

- Extended warranties bundled in: Some lenders push you to buy a 5-year warranty with the loan. That adds $2,000-$4,000 to your balance. You’re paying interest on that warranty. It’s rarely worth it.

- Prepayment penalties: Some loans charge you if you pay off early. Always read the fine print. Co-operative Bank, KiwiBank, and TSB don’t charge this. Most big banks do.

What to do next

Don’t just walk into a dealership and sign whatever they offer. Do this instead:

- Check your credit score on Creditreform or Equifax. If it’s below 700, pay down some debt first.

- Save at least 15% for a down payment. Even 10% helps.

- Apply to Co-operative Bank, KiwiBank, and TSB. They’re your best bets right now.

- Get pre-approved before you go car shopping. That gives you bargaining power.

- Compare the final offer with what the dealership is offering. Often, they’ll match the bank’s rate if you show them the paperwork.

And if you’re buying a used car? Focus on lenders that accept 6-8-year-old vehicles. Co-operative Bank and Heartland Bank still lend on those. ANZ and Westpac often won’t.

Is now the best time to get a car loan?

Yes. The Reserve Bank of New Zealand has cut the OCR to 4.25% as of October 2025. Banks are finally passing those cuts on. Rates are at their lowest since early 2022. If you’ve been waiting for a good deal, this is it.

But don’t wait too long. If inflation picks up again, or if the OCR ticks up in early 2026, these low rates could disappear in weeks. Lock in now while you can.

What credit score do I need to get the lowest car loan rate?

You need a credit score of at least 750 to qualify for the best rates-like 6% or below. Scores between 700 and 749 will still get you decent deals, around 6.5%-7%. Below 700, you’ll likely pay over 8%, and some lenders may decline you outright. Check your score for free on Creditreform or Equifax before applying.

Can I get a car loan with bad credit?

Yes, but not from the best lenders. Subprime lenders like Credible or Auto Finance NZ offer loans to people with scores below 600, but expect rates between 12% and 18%. You’ll also need a larger down payment-often 25% or more-and shorter loan terms. It’s expensive, but it’s a way to rebuild credit if you pay on time.

Should I get a car loan from a dealership or a bank?

Always get pre-approved from a bank or credit union first. Dealerships often mark up the interest rate to earn commission. Even if they say they’re offering ‘0% finance,’ it’s usually a bait-and-switch. A bank loan gives you control. You can walk into the dealership with your approval letter and say, ‘I’m paying cash-what’s your best price?’ That’s how you get the real discount.

Is it better to finance a new or used car?

New cars have lower interest rates and better warranties. But used cars cost less upfront. A 3-year-old car with low mileage can save you 30-40% compared to a brand-new one. If you can find a well-maintained used car under 5 years old, it’s often the smarter financial move-especially if you can get a 6% loan on it. Just avoid cars older than 8 years; rates jump and reliability drops.

How long should my car loan term be?

Five years is the sweet spot. Three-year loans have lower rates but higher monthly payments. Seven-year loans have higher rates and cost you thousands more in interest. You’ll also end up owing more than the car is worth for longer-called being ‘upside down.’ Five years gives you a good balance of affordability and total cost.

Final tip: Don’t just chase the lowest rate

The lowest rate matters-but so does flexibility. If you lose your job or need to pay for an emergency, can you pause payments? Does the lender charge for early repayment? Are there hidden fees? Co-operative Bank and KiwiBank let you skip one payment a year without penalty. Most big banks don’t. That kind of flexibility is worth more than 0.2% off your rate.

Look at the whole picture. The bank with the lowest rate might not be the best bank for you. But right now, Co-operative Bank and KiwiBank are leading the pack-and they’re both worth a closer look.