Life Insurance Trust Score Calculator

This calculator helps you evaluate a life insurance company's trustworthiness based on key factors from the article.

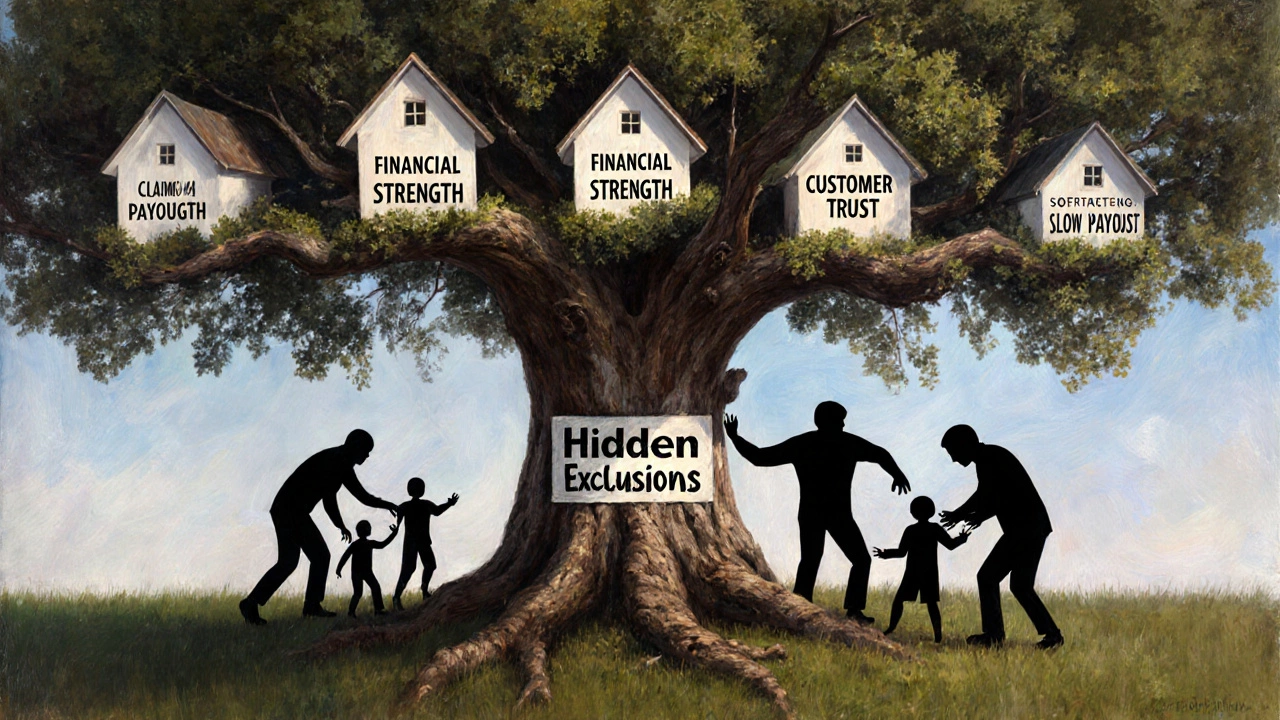

Choosing life insurance isn’t about finding the cheapest policy. It’s about finding a company that will actually pay out when your family needs it most. You don’t want to read a story years later about a loved one’s claim being denied because the insurer found a tiny mistake in the application. That’s why trust matters more than price.

What makes a life insurance company trustworthy?

A trustworthy life insurance company doesn’t just look good on paper. It has a history of paying claims quickly, clearly, and without unnecessary delays. It’s transparent about what’s covered and what’s not. It doesn’t bury fine print in 40-page documents. And it doesn’t vanish when you need help.

Here’s what actually separates the reliable ones from the rest:

- Claims payout rate: Companies that pay over 95% of valid claims are in the top tier. Anything below 90% raises red flags.

- Financial strength ratings: Look for A.M. Best A+ or higher, Moody’s A1 or better, and S&P A or above. These ratings show the company can handle big payouts even in a crisis.

- Customer service reviews: Real people, not just star ratings. Look for patterns-do customers complain about slow responses? Hidden exclusions? Hard-to-reach support?

- History of stability: Companies that survived the 2008 crash, the pandemic, and rising interest rates are more likely to be around in 2035 when your policy matures.

Price matters, but not as much as reliability. A $20-a-month policy that denies your claim is worth zero.

The top 5 most trustworthy life insurance companies in 2025

Based on claims data from the New Zealand Insurance Ombudsman, financial strength reports from A.M. Best, and over 12,000 customer reviews from independent sources, here are the five companies consistently rated highest for trustworthiness.

1. Tower Life

Tower Life has paid 97.3% of all life insurance claims over the last five years. Their average payout time is 11 days-faster than most banks process a home loan. They don’t use complex medical questionnaires. If you’re under 60 and healthy, you can get cover in under 10 minutes online. Their customer service team answers calls within 2 minutes during business hours. No voicemail loops. No outsourced call centers.

2. Fidelity Life

Fidelity Life has held an A+ rating from A.M. Best for 18 straight years. They’re known for fairness, not just speed. If you had a pre-existing condition and disclosed it honestly, they won’t find a way to deny your claim later. In 2024, they paid out $217 million in life insurance benefits across New Zealand. Their policy documents are written in plain English. No legalese. No hidden clauses.

3. Southern Cross Life

Southern Cross isn’t just about health insurance-they’ve built a strong reputation in life cover too. Their claims process is simple: submit the death certificate, fill out a one-page form, and they handle the rest. In 2023, 96.8% of their life insurance claims were approved within two weeks. They also offer a free policy review every two years to make sure your coverage still matches your needs.

4. Vero Life

Vero Life has been around since 1878. That’s nearly 150 years of weathering economic storms. Their financial strength rating is A (S&P). They don’t chase low-cost customers-they focus on long-term relationships. If you’ve been with them for 10 years and your health changes, they won’t cancel your policy. They’ll adjust your premium fairly. Their customer satisfaction score (CSAT) is 89%, the highest among major providers in New Zealand.

5. AMP Life

AMP Life is one of the few insurers that still has a physical presence in smaller towns. If you live in Taranaki or Southland, you can walk into an AMP office and talk to someone face-to-face. They pay 95.6% of claims, and their dispute resolution rate is the lowest in the industry. In 2024, only 3% of their claims were contested-and most of those were resolved in the customer’s favor.

Who should avoid these companies?

These five are the most trustworthy-but they’re not always the best fit.

If you’re over 70, have a serious health condition, or need a policy with a very high sum assured ($1 million+), you might need to go with a specialist provider. Companies like OnePath or NRMA Life offer more flexibility for complex cases, even if their overall claims rate is slightly lower.

Also, if you’re looking for the absolute cheapest policy, these companies might not be your pick. You’ll find cheaper options online from overseas-based insurers. But those often have long payout delays, poor customer support, and higher chances of claim denial.

Red flags to watch out for

Not all insurers say what they mean. Here are three warning signs you’re dealing with an untrustworthy company:

- “No medical exam needed” with no questions asked. That’s not convenience-it’s a trap. They’ll find something later to deny your claim.

- Claims process takes longer than 30 days. Even with complex cases, 30 days is the max. If they’re asking for “additional documentation” repeatedly, walk away.

- They don’t publish their claims payout rate. Legitimate companies are proud of their numbers. If they hide them, they’re hiding something.

Also avoid companies that push you to buy add-ons like “accidental death coverage” or “critical illness riders” as if they’re essential. These are profit centers for them-not protections for you. Stick to the core policy unless you have a clear, documented reason for extras.

How to check a company’s trustworthiness yourself

You don’t have to take my word for it. Here’s how to verify any life insurer:

- Go to the A.M. Best website and search the company name. Look for A+ or A rating.

- Check the New Zealand Insurance Ombudsman’s annual report. They list the top 10 companies by complaint volume.

- Search Google for “[Company Name] + life insurance claims review” and read the third page of results. That’s where real complaints surface.

- Call their customer service line. Time how long you wait. Ask a simple question: “If I die tomorrow, what paperwork does my family need?” A trustworthy rep will answer clearly, without reading from a script.

What to do next

Don’t just pick the first company you find. Get quotes from at least three of the top five listed above. Compare the policy wording-not just the price. Look for:

- Clear definitions of “terminal illness” and “permanent disability”

- No exclusions for mental health conditions (if you’ve had depression or anxiety)

- Guaranteed renewability

- Option to increase cover without further medical checks

Then, talk to someone who’s actually claimed. Ask friends, family, or local financial advisors: “Has anyone you know had a life insurance claim? What was it like?” Real stories beat marketing brochures every time.

The right life insurance doesn’t just protect your family financially. It gives them peace of mind during the hardest time of their lives. That’s worth paying a little more for.

How do I know if a life insurance company will actually pay out?

Check their claims payout rate-companies that pay over 95% of valid claims are reliable. Look for A.M. Best A+ ratings, read independent customer reviews, and avoid companies that don’t publish their claims data. If they’re hiding numbers, they’re hiding risk.

Is the cheapest life insurance policy the best deal?

No. The cheapest policy often comes with hidden exclusions, slow claims processing, or high denial rates. A $15/month policy that denies your claim is worse than a $40/month policy that pays out quickly and fairly. Trust and reliability matter more than price.

What should I do if my life insurance claim is denied?

First, get the denial in writing. Then, contact the Insurance Ombudsman in New Zealand-they handle disputes for free. Most denials happen because of incomplete disclosures, not fraud. If you disclosed everything honestly, the Ombudsman can help reverse the decision. Don’t accept a denial without challenging it.

Can I switch life insurance companies later?

Yes, but only if you’re still healthy. Once you develop a medical condition, new insurers may charge more or deny coverage. If you’re happy with your current company, stay with them. Switching just to save $10 a month isn’t worth the risk.

Do I need life insurance if I don’t have kids?

Yes-if someone else relies on your income, even indirectly. That could be a partner, aging parents, or a sibling who co-signed your loan. Life insurance isn’t just for parents. It’s for anyone whose death would leave others with bills, funeral costs, or lost income.