Retirement Portfolio Calculator

Estimate Your Retirement Income

Key Insight

With your current portfolio and spending, you'll likely have enough funds for 10-15 years. A balanced approach with 30-40% stocks helps maintain purchasing power against inflation while reducing market risk.

Important Note

Always keep 2-3 years of living expenses in cash or short-term bonds to avoid selling stocks during market downturns. This calculator assumes you follow this strategy.

How This Works: Based on historical returns (10% stocks, 3% bonds, 3.2% inflation), we calculate how long your portfolio will last before running out of money. This assumes you withdraw a fixed amount each year, adjusted for inflation.

At 75, your money isn’t just sitting there waiting to grow-it’s working to keep you safe, comfortable, and in control. So, should a 75-year-old be in the stock market? The answer isn’t yes or no. It’s: how you’re in it. Many people assume that once you hit retirement age, you should pull out of stocks completely. That’s a myth. The real question isn’t about age-it’s about goals, timeline, and risk tolerance.

Why age doesn’t automatically mean out of stocks

Life expectancy in New Zealand is now over 83 for men and 85 for women. That means a 75-year-old could reasonably live another 10 to 15 years. If you’re healthy and don’t have a large pension or annuity covering all your expenses, you still need your money to grow. Inflation doesn’t take a break. A cup of coffee that costs $5 today will cost $7 or $8 in 10 years. Bonds and savings accounts can’t keep up. Stocks, even in a balanced portfolio, still have the best long-term shot at beating inflation.Look at the numbers. From 1926 to 2023, the S&P 500 returned about 10% annually on average. Even after adjusting for inflation, that’s roughly 7% real growth. A $100,000 portfolio growing at 5% a year will be worth $163,000 in 10 years. If it sits in a 2% savings account? Just $122,000. That $41,000 gap? That’s real buying power you lose.

What changes when you’re 75

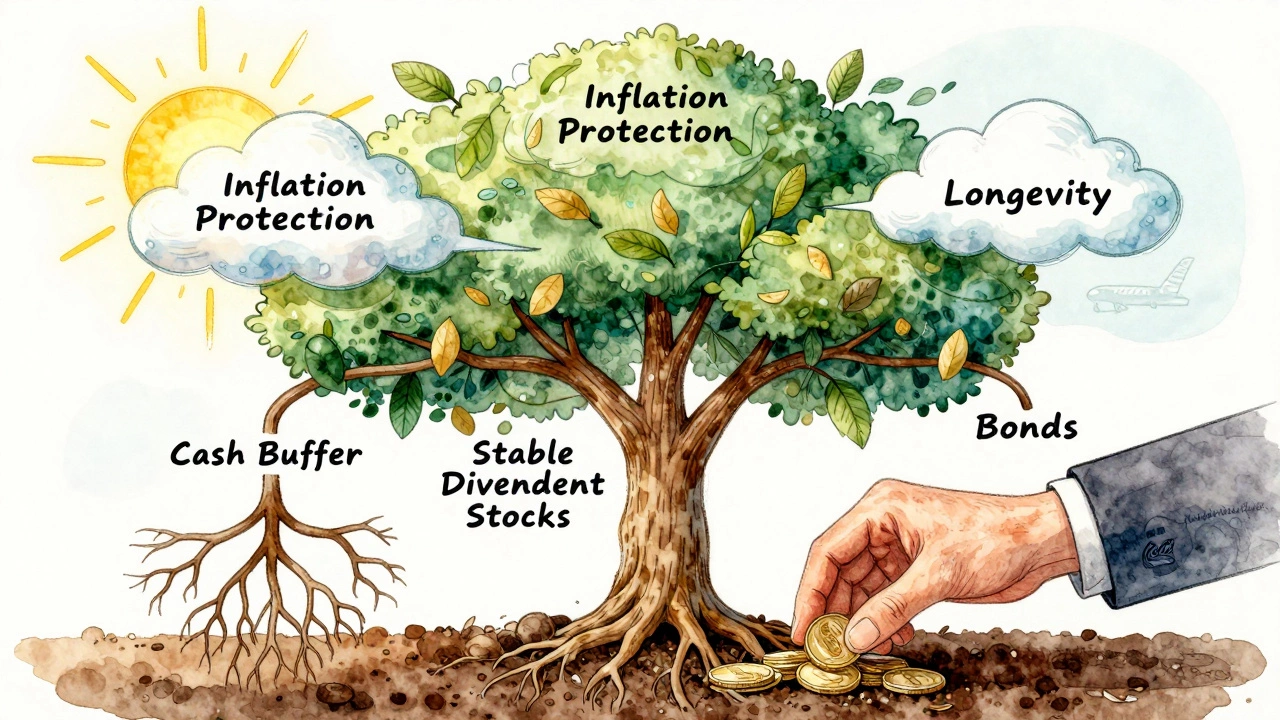

It’s not about getting out of stocks-it’s about changing how you’re in them. Most financial advisors recommend a shift toward stability, not total withdrawal. Here’s what that looks like:- Stocks should make up 20% to 40% of your portfolio, not 70% or 80%

- Focus on dividend-paying companies with strong balance sheets-think Air New Zealand, Transpower, or global giants like Johnson & Johnson

- Use index funds or ETFs instead of picking individual stocks. You’re not trying to beat the market-you’re trying to match it safely

- Keep 2 to 3 years of living expenses in cash or short-term bonds. This lets you ride out market dips without selling low

One client I worked with in Auckland, 78, had 60% of her portfolio in stocks. She was scared. But when we looked at her income: $45,000 a year from NZ Super, $15,000 from a small pension, and $20,000 in annual withdrawals from her savings, her total expenses were $55,000. She needed growth. We shifted her to 35% stocks, mostly in low-cost ETFs tracking the NZX 50 and S&P 500. Her portfolio still dropped 8% in 2022-but because she had cash on hand, she didn’t touch it. By 2024, it was back up 14%.

The danger of going too safe

Too many retirees panic after a market dip and move everything into cash. That feels safe. But it’s often the riskiest move. Cash loses value every year to inflation. In New Zealand, inflation averaged 3.2% from 2018 to 2024. That means if you keep $50,000 in cash, in 10 years, it buys what $37,000 buys today. That’s a 26% loss in real value.And here’s the cruel twist: if you pull out of stocks during a downturn and wait to get back in, you miss the recovery. The market doesn’t wait for you. In 2020, the S&P 500 dropped 34% in March-then climbed 70% by the end of the year. People who sold at the bottom locked in losses. Those who stayed in? They ended up ahead.

Dividends: income without selling

One of the best reasons for a 75-year-old to stay in stocks is dividends. Companies like Fletcher Building, Spark New Zealand, and even global giants like Coca-Cola or Procter & Gamble pay cash every quarter. You don’t have to sell shares to get money-you get paid just for owning them.Let’s say you have $80,000 in dividend stocks with a 4% yield. That’s $3,200 a year, paid out monthly. That’s like a mini-pension. You can use it for groceries, travel, or medical co-pays. And if the company raises its dividend? Your income goes up. That’s inflation protection built in.

When to reduce or exit

There are times when reducing stock exposure makes sense:- You need to access a large amount of money in the next year-for a home repair, medical procedure, or helping a grandchild

- You panic every time the market dips, even if you don’t sell

- You have enough guaranteed income (NZ Super + pension + annuity) to cover all your expenses with room to spare

If you’re in that last group, you can afford to be conservative. But if you’re relying on your portfolio to stretch your budget, you still need growth. The goal isn’t to eliminate risk-it’s to manage it.

What to avoid

Avoid these common traps:- Buying crypto or speculative stocks to "get rich quick"

- Putting everything into one company-even if it’s a local business you trust

- Listening to advice like "You’re too old for stocks" from a well-meaning friend who hasn’t done the math

- Ignoring fees. High-cost managed funds can eat 2% a year. That cuts your returns in half over time

Stick to low-cost ETFs. Use platforms like Sharesies or InvestNow. They’re simple, transparent, and designed for people who don’t want to spend hours managing their money.

Real-life example: Jack, 76, from Hamilton

Jack retired at 68. He had $320,000 saved. His NZ Super covered his rent and utilities. He wanted to travel and help his kids. He had been in 100% bonds since retirement. In 2023, he realized his savings weren’t stretching far enough. He was dipping into principal just to cover $1,000 a month of extra spending.We restructured his portfolio:

- $60,000 in cash (2 years of extra spending)

- $120,000 in NZX 50 ETF

- $80,000 in global dividend ETFs

- $60,000 in short-term government bonds

His annual dividend income jumped from $1,200 to $8,400. He didn’t have to sell a single share to pay for his annual trip to Australia. And when the market dipped in late 2024, he didn’t panic. He knew his cash buffer had his back.

Final thought: It’s not about age. It’s about planning.

A 75-year-old doesn’t need to be in the stock market the same way a 35-year-old is. But they still need growth. The difference isn’t in whether you’re invested-it’s in how carefully you’re invested. A smart portfolio at 75 isn’t about chasing returns. It’s about preserving dignity. It’s about having choices. It’s about not becoming a burden. And yes-it’s about making sure your money lasts as long as you do.Is it too risky for a 75-year-old to have stocks in their portfolio?

It’s not about risk-it’s about balance. A 75-year-old should have a small portion of their portfolio in stocks, typically 20% to 40%, focused on stable, dividend-paying companies or low-cost index funds. The rest should be in cash and bonds for safety. This mix reduces volatility while still protecting against inflation. The real risk isn’t having stocks-it’s having too little growth and losing buying power over time.

Should a 75-year-old sell stocks during a market crash?

No. Selling during a crash locks in losses. Instead, keep 2 to 3 years of living expenses in cash or short-term bonds. That way, you don’t need to sell stocks when prices are low. History shows markets always recover. In 2020, the S&P 500 dropped 34% in March but gained 70% by year-end. Those who sold missed the rebound. Those who stayed invested recovered faster and often ended up ahead.

Can a 75-year-old still benefit from dividend stocks?

Yes-dividend stocks are one of the best tools for retirees. They provide regular income without needing to sell shares. A portfolio with 4% yield on $100,000 generates $4,000 a year. Companies like Spark, Fletcher Building, or global giants like Johnson & Johnson have raised dividends for decades. This income grows with inflation, helping you keep up with rising costs without touching your principal.

What’s the best way for a 75-year-old to invest in stocks?

Use low-cost ETFs that track broad markets. For New Zealand exposure, try NZX 50 ETFs. For global growth, use S&P 500 or global dividend ETFs. Avoid individual stock picking. Platforms like Sharesies or InvestNow make it simple and cheap. Keep fees under 0.3% a year. Diversify across sectors and countries. And never put more than 40% of your portfolio in stocks-unless you have a guaranteed income that covers all your needs.

How much cash should a 75-year-old keep on hand?

Keep enough cash to cover 2 to 3 years of non-essential spending. This includes travel, medical co-pays, home repairs, or gifts to family. If you need $15,000 a year for extras, keep $30,000 to $45,000 in a high-interest savings account or term deposit. This buffer lets you ride out market downturns without selling investments at a loss. It’s your safety net.