Remortgage Cost Calculator

Monthly Payment Change

Total Interest Paid

Switching your mortgage might sound like a smart move-lower rates, better terms, or cash out for home improvements. But not every remortgage saves you money. In fact, some traps can cost you more than you save. If you’re thinking about remortgaging in New Zealand in 2025, you need to know the downsides before you sign anything.

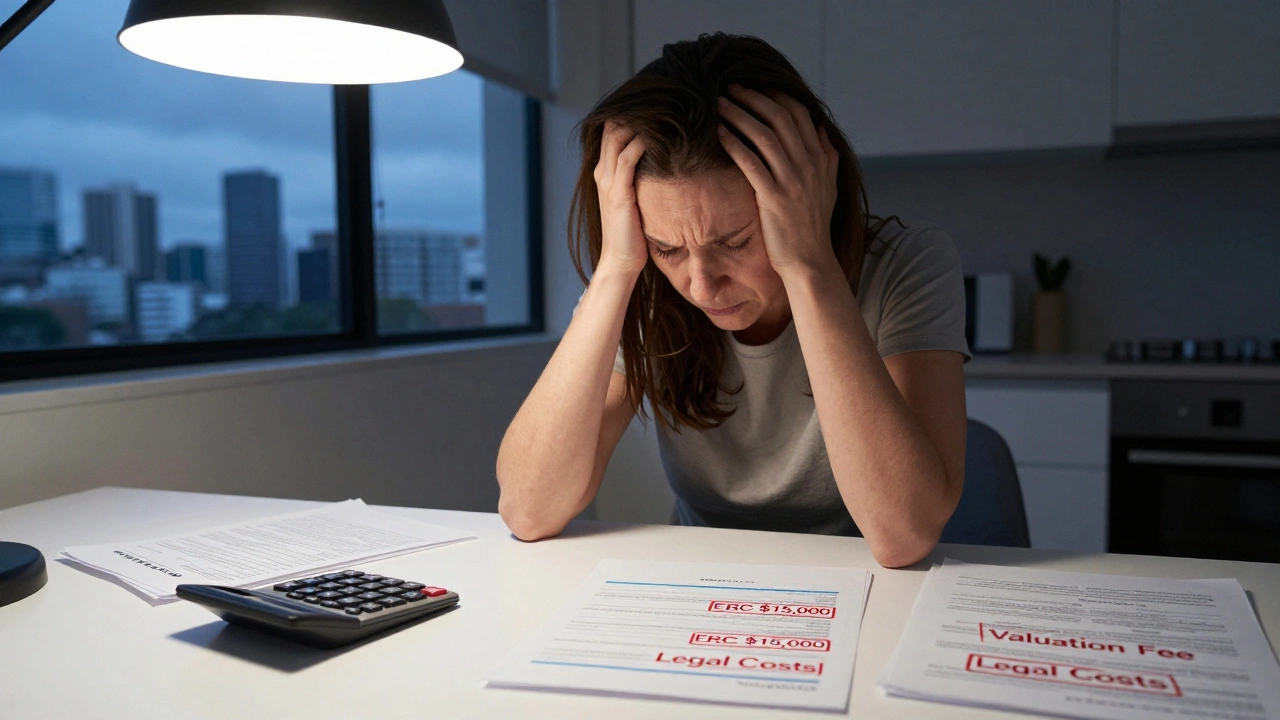

You’re Paying Fees You Forgot About

Most people focus on the interest rate when remortgaging. But fees can eat up your savings fast. Lenders charge arrangement fees, valuation fees, legal fees, and early repayment charges. In New Zealand, early repayment charges (ERCs) are common if you’re still in a fixed-rate term. If you lock in at 3.5% for three years and switch after 18 months, you could pay 2% to 3% of your remaining balance just to get out. On a $600,000 mortgage, that’s $12,000 to $18,000 in penalties alone.Even if your current lender doesn’t charge ERCs, your new lender will likely charge setup fees. These can range from $500 to $3,000. Add in a property valuation ($300-$800) and lawyer fees ($800-$1,500), and you’re already out $3,000-$6,000 before you even get your first payment.

Your Credit Score Takes a Hit

Every time you apply for a new mortgage, the lender runs a hard credit check. One check might not hurt much. But if you’ve applied to three or four lenders in the past six months, your credit score could drop by 15 to 30 points. That’s not just a number-it affects your ability to get other loans, credit cards, or even rental applications.Some people think they can shop around without damage. But in New Zealand, credit bureaus like Equifax and Centrix treat multiple mortgage applications in a short window as a red flag. It looks like you’re desperate for credit. That can make lenders wary-even if you’ve got a perfect payment history.

Extending Your Loan Term Costs More Long-Term

A lot of remortgage offers tempt you with lower monthly payments. But they do it by stretching your loan term. Let’s say you’ve been paying on a 25-year mortgage for 8 years. You’ve got 17 years left. Your new lender offers you a 30-year term to lower your repayments. Sounds good, right?Here’s the catch: you’re now paying interest for 13 more years. On a $500,000 loan at 6.5%, that extra 13 years adds over $180,000 in interest. You’re saving $200 a month now, but you’ll pay $1,100 more every month in the long run. That’s not a deal-it’s a trap.

You Might Lose Your Lender’s Benefits

If you’ve been with your current lender for years, you might be getting perks you didn’t even notice. Free home insurance, discounted transaction fees, cashback on bills, or waived account-keeping fees. These add up. One client in Auckland switched to a cheaper rate but lost her $1,200 annual home insurance discount. Her new lender didn’t offer anything comparable. She ended up paying more overall.Some lenders even offer loyalty bonuses after five or seven years. If you remortgage before hitting that milestone, you forfeit it. Don’t assume your new lender will match these perks. They rarely do.

Property Values Could Drop

Remortgaging often depends on your home’s value. Lenders use loan-to-value ratios (LVR) to decide how much they’ll lend you. If your property has dropped in value since you bought it, you might not qualify for the rate you expected.In 2024 and early 2025, Auckland’s house prices dipped 8% in some suburbs. If your home was worth $800,000 when you got your original mortgage but is now $720,000, and you owe $600,000, your LVR jumps from 75% to 83%. That puts you over the 80% threshold where lenders charge higher interest or require mortgage insurance. Suddenly, your "great deal" isn’t so great anymore.

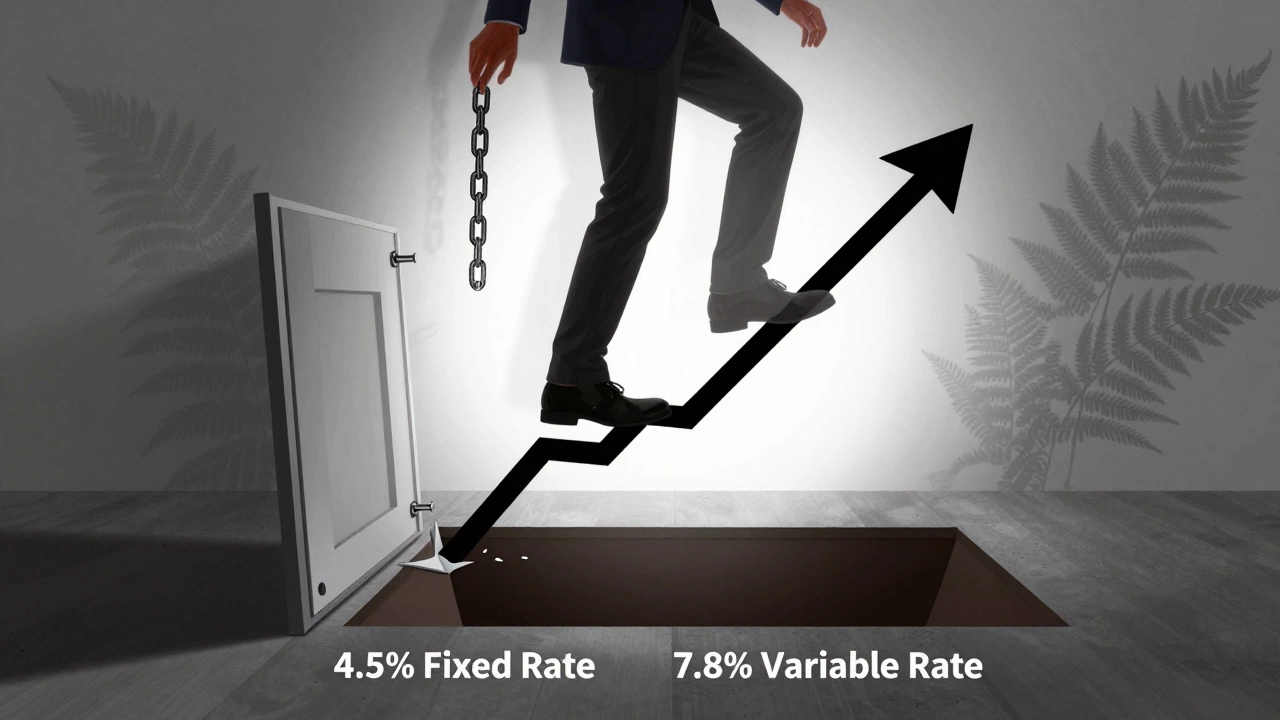

You Could Get Locked Into a Worse Rate Later

The new rate you’re offered today might look amazing. But what happens when it expires? Many fixed-rate deals last only one or two years. After that, you roll onto the lender’s standard variable rate-which in 2025 is hovering around 7.8% in New Zealand.Some people remortgage to get a 4.5% fixed rate for two years. Then, when it ends, they’re stuck paying 7.8% because they didn’t plan ahead. If interest rates stay high, you could end up paying more than you did before. Remortgaging isn’t a one-time fix. It’s a cycle. And if you’re not careful, you’ll be stuck in it forever.

It’s Not Always Worth It for Small Savings

A lot of people remortgage because they found a rate 0.5% lower. But is it worth the hassle? Let’s say you owe $450,000 and your current rate is 6.7%. You find a 6.2% deal. That saves you about $225 a month.But if your fees total $5,000, it’ll take you 22 months just to break even. If you plan to move in three years, you’re still out $2,000. And that’s before considering the stress, paperwork, and time spent dealing with lawyers and valuers.

Only remortgage if you’re saving at least 0.75% on your rate and plan to stay put for at least four years. Otherwise, you’re better off sticking with what you’ve got.

You Might End Up Borrowing More Than You Need

Cash-out remortgages are popular. You refinance for more than you owe and take the difference in cash-for renovations, a car, or a holiday. But you’re turning unsecured debt into secured debt. That means your home is now on the line.And here’s the thing: most people who take cash out don’t pay it back faster. They just spread it over 25 more years. So that $30,000 for a kitchen upgrade? You’ll end up paying $70,000 for it over time. And if your income drops or interest rates rise, you could struggle to keep up.

Use a cash-out remortgage only if you’re improving your home’s value. Otherwise, it’s just debt in disguise.

Regulations Are Tightening

In 2024, New Zealand’s Reserve Bank introduced stricter lending rules. Banks now have to prove you can afford repayments even if rates rise another 2%. That means tighter affordability tests. If you’ve got a variable income, are self-employed, or have other debts, you might not qualify for the new loan-even if you had no trouble getting your original one.Some lenders have stopped offering remortgages to people with LVRs above 80%. Others require proof of six months’ savings. If your financial situation changed since you got your first mortgage, you could be turned down. And then you’re stuck with your old loan and no backup plan.

What If You Regret It?

Once you sign, you’re locked in. There’s no cooling-off period for mortgages in New Zealand. If you realize your new lender is slow to respond, has poor customer service, or charges hidden fees later, you’re stuck. Switching again means going through all the fees and credit checks again.Some people regret remortgaging because they didn’t read the fine print. One woman in Wellington switched to a "no-fee" mortgage, only to find out later she had to pay $1,200 every year for a "service fee". She didn’t know it was buried in the contract. She ended up paying $6,000 more over five years.

Always get a copy of the full contract. Read every line. Ask for clarification on anything unclear. If the lender won’t explain it, walk away.

Is remortgaging worth it if I just want a lower monthly payment?

Not always. Lower monthly payments often come from extending your loan term, which means you pay more interest over time. If you’re only saving $100-$200 a month but your fees are $5,000, it’ll take years to break even. Only do it if you plan to stay in your home for at least four years and are saving at least 0.75% on your interest rate.

Can I remortgage if I have bad credit?

It’s harder. Lenders in New Zealand now require stronger credit histories, especially if your loan-to-value ratio is above 80%. If your credit score dropped due to missed payments or high credit card balances, you may be declined-or offered a much higher rate. Focus on improving your credit first before applying.

How long should I wait before remortgaging?

Wait until your fixed-rate term ends to avoid early repayment charges. If you’re on a variable rate, wait at least 18 months. That gives you time to build equity and improve your credit. Most experts recommend waiting two to three years before considering a switch.

Do I need a solicitor to remortgage?

Yes. In New Zealand, it’s legally required to use a solicitor for mortgage changes. They handle the paperwork, title transfers, and ensure everything is registered correctly. Don’t skip this step-even if your lender offers a "free conveyancing" deal. Those deals often come with hidden costs or lower-quality service.

What’s the biggest mistake people make when remortgaging?

They focus only on the interest rate. The real cost is in fees, loan term length, and future rate resets. Many people end up paying more over time because they didn’t look beyond the first year. Always run the numbers for the full life of the loan, not just the first 12 months.

Final Thought: Is This Really the Right Move?

Remortgaging isn’t a magic solution. It’s a financial tool-and like any tool, it can cut both ways. If you’re doing it to save money, make sure you’re actually saving. If you’re doing it to get cash, ask yourself if you really need to borrow more against your home. And if you’re just bored with your lender, consider whether a phone call to your current bank might get you a better deal without all the hassle.The best remortgage is the one you don’t do. But if you’ve done your homework, run the numbers, and still think it’s right-then go ahead. Just don’t let a low monthly payment blind you to the long-term cost.