Home Insurance Premium Calculator

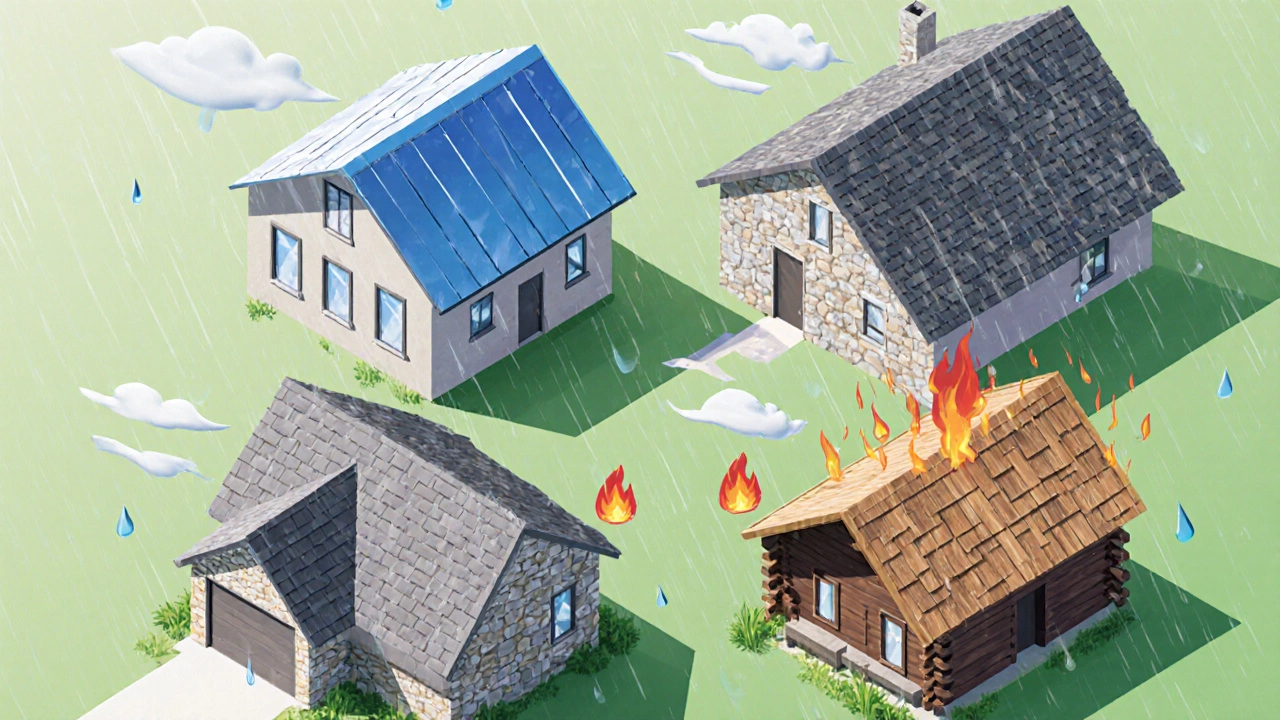

Homeowners insurance premium is the amount you pay each year to keep your house protected against fire, theft, natural disasters, and liability. Insurers look at a bundle of risk factors to decide that price, and the type of house you live in can swing the cost dramatically.

Key Takeaways

- Single‑family homes on larger lots often cost more than condos or townhouses because they have more exposed surface area.

- Brick or concrete walls, metal roofs, and modern fire‑sprinkler systems can shave 5‑15% off a premium.

- Living in a low‑risk zip code (away from flood zones, wildfires, and high winds) is one of the biggest discounts available.

- Higher deductibles and tighter coverage limits lower the price, but they raise out‑of‑pocket costs when a claim occurs.

- Installing security cameras, deadbolts, and smart alarms can earn additional discounts from most carriers.

How Insurers Calculate Your Premium

Insurance companies treat premium calculation like a risk‑scoring engine. They gather data, assign a weight to each factor, and sum the scores. The basic formula looks like this:

- Base rate: set by the insurer for the state or region.

- +

- Risk modifiers: each attribute (roof type, location, age) adds or subtracts a percentage.

- +

- Policy choices: deductible, coverage limits, and optional add‑ons.

- =

- Final premium.

In plain language, a home with a metal roof in a low‑wind county, protected by a burglar alarm, and a $1,500 deductible will end up with a lower final number than a wooden‑shingle house on a floodplain with a $250 deductible.

House Types and Their Typical Impact

| House Type | Average Premium (USD) |

Typical Discount / Surcharge | Why It Matters |

|---|---|---|---|

| Condominium | $800 | ‑10% to ‑15% | Shared walls reduce exposure; association often enforces fire‑sprinklers. |

| Townhouse | $950 | ‑5% to ‑10% | Partial sharing of walls cuts fire spread risk. |

| Single‑Family (brick) | $1,250 | 0% (baseline) | Solid construction but fully exposed roof and perimeter. |

| Single‑Family (wood) | $1,400 | +5% to +10% | Wood siding is more flammable; insurers charge extra. |

| Mobile Home | $1,600 | +10% to +20% | Often located in high‑wind parks; less sturdy framing. |

The numbers above come from a 2024 industry survey of the five biggest U.S. carriers. They show that the lower homeowners insurance premium tends to belong to compact, low‑profile dwellings like condos and townhouses, especially when built with non‑combustible materials.

Construction Materials & Roof Types

Roof material alone can shift a premium by 5‑15%.

- Metal roofs reflect heat, shed water quickly, and resist wind uplift. Insurers reward them with up to a 12% discount.

- Concrete or slate tiles are heavy and fire‑resistant, often earning a 7‑10% reduction.

- Asphalt shingles are the most common but also the most vulnerable to wind and fire. They typically add a small surcharge.

- Wood shakes score the highest risk for fire and wind, leading to the steepest premiums.

Walls matter too. Brick, stone, or insulated concrete forms (ICFs) lower fire spread risk, while vinyl siding adds little protection and may increase rates.

Location and Natural Hazard Risks

Where you live trumps many other variables. Insurers use zip‑code level data from FEMA, the National Flood Insurance Program, and wind‑risk maps.

- Flood zones (AE, AH, V): homes inside these zones must buy a separate flood policy, and the base homeowners premium spikes by 20‑30%.

- Wildfire corridors: proximity to dense forest or brush adds a 15‑25% surcharge.

- Coastal hurricanes: wind‑storm risk factors can push premiums upward 10‑20%.

- Low‑risk suburbs: flat terrain, good drainage, and low crime rates can pull premiums down by up to 12%.

Even within a single city, neighborhoods differ dramatically. A house on a hill with a clear roofline may beat a valley‑floor home that traps moisture.

Home Age, Renovations, and Maintenance

Older homes often have outdated wiring, plumbing, and heating systems. Insurers see that as higher odds of accidental loss.

- Homes built before 1978 may contain old knob‑and‑tube wiring-many carriers add a 5‑10% surcharge unless upgraded.

- Renovated kitchens or bathrooms with modern, code‑compliant fixtures can shave a few percent off the quote.

- Regular roof inspections and prompt repairs demonstrate risk mitigation and may earn a discount.

When you finance a remodel, ask the contractor to provide documentation of all upgrades. Having receipts on file speeds up the discount‑approval process.

Safety Features and Mitigation Measures

Security and fire‑prevention devices are the most direct way to earn discounts.

- Smoke detectors: A working detector in every bedroom and on each level can reduce premiums by 5%.

- Fire‑sprinkler systems: Residential sprinklers cut fire‑damage odds dramatically; many insurers offer 10‑15% off.

- Deadbolt locks + smart doorbells: Combined, they can fetch a 3‑7% discount.

- Impact‑resistant windows: Especially in hurricane‑prone zones, these windows may lower wind‑damage surcharges.

Most carriers require proof of installation-photographs, receipts, or a certificate of compliance-before applying the discount.

Policy Choices That Influence Cost

The way you structure the policy itself also changes the premium.

- Higher deductible: Raising the deductible from $500 to $1,500 usually drops the premium by 5‑10%.

- Coverage limits: Opting for “actual cash value” (ACV) instead of “replacement cost” can save a few bucks, but you’ll receive less after a loss.

- Bundling: Combining home and auto policies with the same insurer often yields a 5‑15% multi‑policy discount.

- Claims‑free bonus: After three years without a claim, many carriers give a “no‑claims” discount of up to 10%.

Always run a cost‑benefit analysis. A higher deductible saves money now but could leave you strapped for cash after a major incident.

Actionable Checklist to Lower Your Premium

- Identify your home’s construction material and roof type; consider upgrading to metal or slate if feasible.

- Run a zip‑code risk report (FEMA flood map, wind‑storm map) and see if you qualify for a low‑risk discount.

- Install smoke detectors in every bedroom and a fire‑sprinkler system if your budget allows.

- Add a smart security system with cameras, motion sensors, and deadbolts.

- Raise your deductible to a level you could comfortably pay out‑of‑pocket.

- Bundle your home policy with auto or umbrella insurance.

- Ask for a no‑claims discount after three claim‑free years.

- Provide the insurer with receipts for all upgrades and recent home inspections.

- Review your coverage annually; life changes (remodels, new pool, added garage) can affect rates.

- Shop around every 2‑3 years-rates can vary 20% between carriers even for identical risk profiles.

Mini FAQ

Does a brick house always cost less to insure?

Brick is fire‑resistant, so insurers usually give a modest discount. However, if the house sits in a floodplain or has an old roof, the savings may be offset by other risk factors.

Can I get a discount for living in a gated community?

Yes. Gated communities often have lower crime rates and may include private security patrols, which can shave 5‑8% off the premium.

How much does a metal roof typically save?

Most carriers offer a 10‑12% discount for metal roofs because they are wind‑tight and fire‑resistant.

Is it worth buying flood insurance separately?

If you live in a high‑risk flood zone, a separate flood policy is mandatory and can prevent a financially devastating loss. In low‑risk areas, the optional policy may still be a smart safety net.

Do older homes always pay more?

Not always. An old home that has been fully updated-new wiring, modern roofing, and added safety devices-can qualify for the same or lower rates as a newer build.

By understanding which house characteristics drive risk, you can make smarter buying or renovation decisions that keep your insurance bill in check. The right combination of construction material, location, safety upgrades, and policy tailoring usually yields the most lower homeowners insurance premium you can realistically achieve.