Balance Transfer Calculator

Calculate Your Savings

Determine if a balance transfer can save you money on credit card debt. Enter your current details to see potential savings.

Balance transfer fees typically range from 3% to 5%. Always confirm the exact fee with your new card issuer.

You can’t directly pay one credit card bill by using the same card to make a payment. But you can pay one credit card with another - and lots of people do it every day. The trick isn’t about magic or loopholes. It’s about how credit card companies let you move debt around, not create money out of thin air.

Why You Can’t Pay a Credit Card With Itself

Think of your credit card like a loan. When you swipe or tap, you’re borrowing money from the issuer. That money has to come from somewhere - not from the card itself. The card doesn’t hold funds. It’s a line of credit. So when you try to pay your bill using the same card, the system sees it as a request to borrow more to pay back what you already borrowed. That’s not allowed. It’s like trying to refill your gas tank by pouring gas from the same tank into itself. It just doesn’t work.Most online payment portals and phone systems will block you if you try to use the same card number to pay the bill. Even if you manually enter the card number, the issuer’s fraud and risk engine will flag it as invalid. Some people try to use third-party payment apps like PayPal or Zelle to route the payment, but those platforms also check the source and destination. If they detect you’re trying to pay a credit card with the same card, they’ll reject it.

How People Actually Pay One Credit Card With Another

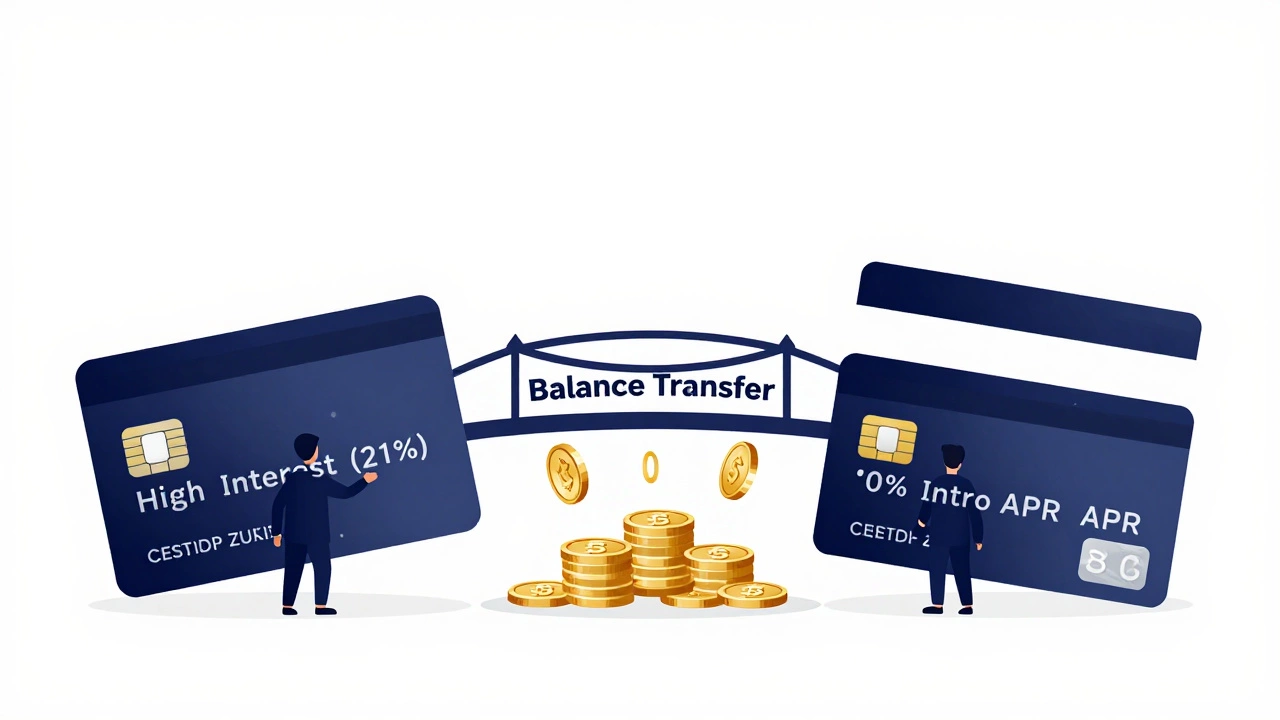

The real answer lies in balance transfers. This is a standard, legal, and widely used method to move debt from one credit card to another. It’s not a trick. It’s a financial tool built into the system.Here’s how it works: You apply for a new credit card that offers a 0% introductory APR on balance transfers - often for 12 to 21 months. Once approved, you request a balance transfer from your old card to the new one. The new issuer pays off your old card directly. Then you owe the new issuer instead. You’re not paying with cash. You’re swapping debt from one lender to another.

Most issuers charge a balance transfer fee - usually 3% to 5% of the amount moved. So if you transfer $5,000, you’ll pay $150 to $250 upfront. That fee is added to your new balance. But if you’re moving high-interest debt (say, 22% APR) to a 0% card, you save hundreds or even thousands in interest over the next year or two.

When a Balance Transfer Makes Sense

A balance transfer isn’t right for everyone. It’s a tool for people who have a clear plan to pay off debt before the promotional rate ends.- Good fit: You have $4,000 on a card charging 21% APR. You can pay $300 a month. At that rate, you’d pay $1,100 in interest over 15 months. A 0% balance transfer card with a 12-month intro period and a 3% fee ($120) would let you pay $333 a month - no interest, and you’d be debt-free in 12 months.

- Bad fit: You transfer $3,000 to a 0% card, then keep spending on both cards. You now have $7,000 in debt and two minimum payments. The 0% period ends, and you’re hit with 20%+ interest on both.

Balance transfers work best when you stop using the old card, make a payment plan, and stick to it. Many people use them to buy time - not to avoid paying.

What Happens If You Try to Pay With the Same Card?

Some people try to get around the system by using cash advances or convenience checks. You might think: “I’ll take a cash advance on Card A, then use that cash to pay Card B.” That sounds smart - until you look at the costs.- Cash advances usually cost 3% to 5% in fees - same as balance transfers.

- They start accruing interest immediately - no grace period.

- Interest rates on cash advances are often higher than regular purchases - sometimes over 25%.

- Card issuers treat this as a red flag. It looks like you’re in financial distress.

Even worse, if you use a cash advance to pay a credit card bill, you’re still paying interest - just at a worse rate. You’re not solving the problem. You’re making it more expensive.

Alternatives to Paying One Card With Another

If you’re struggling to pay your credit card bill, there are better options than juggling cards:- Payment plan with your issuer: Most banks offer hardship programs. Call them. You might get reduced interest, lower payments, or a pause for a few months.

- Personal loan: A fixed-rate personal loan from a bank or credit union can consolidate debt at a lower rate than most credit cards. Rates as low as 8% to 12% are common for good credit.

- Debt management plan: Nonprofits like Money Management International or National Foundation for Credit Counseling help you consolidate payments and negotiate lower rates. They work with your creditors directly.

- Side income: Even $200 a month from freelancing, selling unused items, or driving for a delivery app can make a big difference over time.

What You Should Never Do

Avoid these common traps:- Using your credit card to pay another credit card bill via a third-party app. Apps like PayPal or Venmo may let you send money from a card, but the recipient (your credit card issuer) will likely reject it. Even if it goes through, you’re still paying a fee and accruing interest.

- Maxing out multiple cards to pay each other. This is a classic debt spiral. Your credit utilization skyrockets, your score drops, and lenders see you as high-risk.

- Ignoring the balance transfer fee. Some people focus only on the 0% APR and forget the upfront cost. Always calculate the total cost - fee + interest saved.

How to Do a Balance Transfer Right

If you decide to go this route, here’s a simple checklist:- Check your credit score. You need good to excellent credit (670+) for the best 0% offers.

- Compare balance transfer cards. Look for the longest 0% period, lowest fee, and no annual fee.

- Calculate your total cost: transfer fee + monthly payment needed to pay off before intro period ends.

- Apply for the new card. Don’t apply for multiple cards at once - it hurts your score.

- Once approved, request the transfer. Make sure the old card is paid off in full.

- Stop using the old card. Cut it up if you have to.

- Set up automatic payments on the new card. Don’t miss a due date.

- Pay more than the minimum every month. Aim to clear the balance before the 0% period ends.

What Happens After the 0% Period Ends?

If you still have a balance when the promotional rate expires, the issuer will apply the regular APR - often 18% to 24%. That’s when many people get stuck.That’s why timing matters. If you can’t pay off the balance in 12 to 18 months, a balance transfer might not help. A personal loan with a fixed 3-year term and a 10% rate might be a better fit. It gives you structure. No surprises.

Bottom Line

You can’t pay a credit card bill with the same card. But you can absolutely pay one credit card with another - through a balance transfer. It’s not cheating. It’s a smart financial move if you have a plan. The key isn’t finding a loophole. It’s using the tools available to reduce interest and pay down debt faster.Don’t use this to keep spending. Use it to stop the bleeding. Then, build a real plan to get out of debt for good.

Can I pay my credit card bill with a different credit card?

Yes, but only through a balance transfer. You can’t pay directly using the other card’s details online or over the phone. Instead, you apply for a new card that offers a 0% intro APR on balance transfers. The new issuer pays off your old card, and you now owe the new one. There’s usually a fee (3%-5%) and you must pay off the balance before the promotional rate ends.

Is it bad to pay one credit card with another?

It’s not bad if you do it the right way - with a balance transfer and a plan to pay off the debt. But it’s risky if you’re just moving debt around without reducing it. If you keep using both cards, you’ll end up with more debt and higher interest. The goal is to reduce your total debt, not just shift it.

What’s the cheapest way to pay off credit card debt?

The cheapest way is to pay more than the minimum each month while avoiding new charges. If you have high-interest debt, a balance transfer card with 0% intro APR can save you hundreds in interest. For longer-term debt, a personal loan with a fixed rate (8%-12%) is often cheaper than carrying a credit card balance. Avoid cash advances - they cost more and start accruing interest immediately.

Can I use PayPal to pay my credit card bill with another credit card?

Technically, you might be able to send money from one card to your bank account via PayPal, then use that to pay your bill. But PayPal charges a fee for card transfers (2.9% + $0.30), and your credit card issuer may treat it as a cash advance - which means high interest from day one. It’s expensive, complicated, and not recommended.

Will paying a credit card with another card hurt my credit score?

It can, if you do it wrong. Opening a new card for a balance transfer causes a hard inquiry, which drops your score a few points. High credit utilization on either card can also hurt your score. But if you pay down the balance quickly and keep old accounts open, your score can improve over time. The key is reducing total debt, not just moving it.

What if I can’t pay my credit card bill at all?

Call your issuer. Most banks offer hardship programs - they can lower your interest rate, reduce your payment, or pause payments for a few months. Don’t wait until you miss a payment. The sooner you reach out, the more help you can get. Nonprofit credit counseling agencies can also help you set up a debt management plan.